What is a homeowners insurance protection class? (How It Affects Rates)

A homeowner's insurance protection class is a factor that determines your home insurance rates per year. Classes range from one to ten, where Class 1 is the least expensive and Class 10 is the most expensive. Your home insurance protection class's overall cost is determined by how well your community responds to fire safety and water supply agencies. Read on for an easy-to-understand list of home insurance protection classes and what they mean, or compare rates and find the best coverage for your home by entering your ZIP code above.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

William Lemmon

Principal Broker

William Lemmon has been a licensed insurance agent for over 12 years. He is the principal broker and owner of Broadway Insurance Services in Los Angeles, CA. He works one-on-one with clients to create personalized plans that minimize risk and maximize savings. Being one of the foremost authorities on Airbnb and home-sharing property insurance, Lemmon offers his clients first-hand guidance on how t...

Principal Broker

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Overview

- Public protection class and fire protection class are two terms for the same classification of a community’s fire suppression capabilities,

- Protection classes are determined using a 100-point scale by the Insurance Services Organization,

- The protection class of your home will impact your homeowners insurance rates.

You’re moving out to a rural area, and you have questions about reading your homeowners insurance policy and locating the top ten home insurance companies. You realize it’s more expensive than you anticipated due to your new address’s homeowners insurance protection class.

We’ll break down the protection classes and explain what the number means and how it’s calculated. We’ll also explain what the class designation means to you and your home insurance premium.

Read on for an easy-to-understand list of home insurance protection classes and what they mean, or compare rates and find the best coverage for your home by entering your ZIP code above.

What is a homeowners protection class?

Public protection classes (PPC) are codes that range from 1–10, with additional levels attached to each number, such as 1X. A community can also earn a split classification, which we’ll cover in more detail later.

Class 1 is the least expensive, and Class 10 is the most expensive. These codes are calculated using several different factors, all of which add up to a number identifying the risk level your home presents to the insurance company in terms of fire damage.

Protection class ratings deal with fire protection capabilities in a particular community. While they’re officially called public protection classes, they’re often referred to as fire protection classes.

What’s the fire protection class definition?

A fire protection class tells the insurance company how much it will likely cost the insurance company if there is a fire at your house.

Your agent tells you the new home requires protection class 10 homeowners insurance, which means homeowners insurance costs will be a lot more than it would be under a different class designation.

Read more: Types of Homeowners Insurance

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does the homeowners insurance protection class affect my rate?

You may have these questions as you move forward:

- What protection class is my home in?

- Why is the rate higher?

- What is a homeowners insurance protection class? What do the numbers mean?

It’s confusing on the surface, but we’ll explain.

You probably already know homeowners’ insurance rates are determined based on many factors, some of which have to do with the insurance company’s risk level. For these companies, Public Protection Classes (PPC) are a part of calculating that risk to determine your rate.

But what is protection Class 3 on homeowners insurance, what does protection Class 9 mean, and why is Class 10 insurance more expensive than the others?

It may seem random or even unfair, but there’s a solid system behind determining protection classes, and there is a good reason for using them.

You don’t have time to make sense of insurance company data, so we’re here to help.

Read more: Who is covered under homeowners insurance?

How do protection classes determine fire protection?

Being in protection Class 1 and protection Class 2 generally means your home is located in an area with superior fire protection. Conversely, if your property is located in Class 10, your community is on the very low end of the fire protection spectrum.

In other words, the risk of a lot of damage to your home from a fire is high because your community isn’t equipped to get the fire out fast.

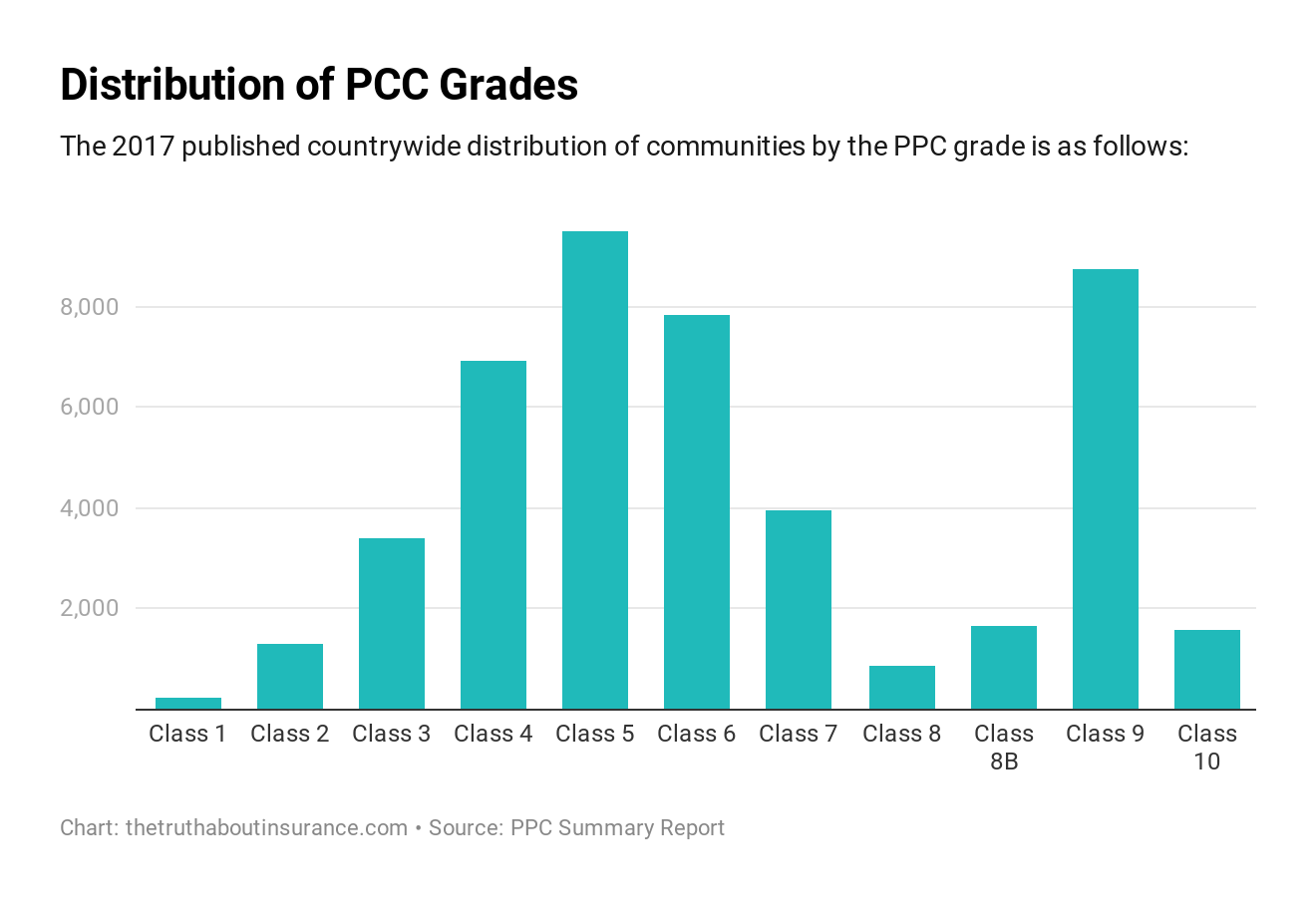

The chart above shows the distribution of protection classes across the United States. As you can see, most areas fall in the range of home insurance protection Class 4 through Class 6.

It’s interesting to note that nearly as many areas fall into Class 9 as in Class 6. Let’s talk a little more about Classes 9 and 10.

Fire Protection Classes 9 & 10

You may encounter difficulty obtaining homeowners insurance in the standard market if your property is located in an area with a PPC higher than an 8.

A Class 9 grading means the community’s fire-protection system meets ISO requirements (we’ll cover what this means shortly), but the water supply system does not. A Class 10 grading means the community’s fire-protection system does not meet ISO requirements.

Verisk, which gathers data for the insurance industry, mapped a total of 1,559 fire departments in the United States that lack the capacity to respond to a structure fire. These communities, therefore, don’t meet the requirements and would be designated Class 10.

Class 10 denotes an area that doesn’t meet ISO requirements and is considered unprotected.

Some insurers refuse to insure homes in these locations at any price. This may mean you will have to look for coverage elsewhere. We’ll talk a bit more about your options later.

We’ll take a closer look at all of the factors used to determine a protection class in a later section as well. First, let’s talk about where these classes come from and who chooses them.

We’ve just mentioned both ISO and Verisk. Let’s find out who they are.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How is the public protection class determined?

Your protection class is determined by the Insurance Services Organization, known as “ISO” (pronounced “eye-so”) in insurance circles. ISO is a brand name owned by a company called Verisk.

Verisk and Insurance Services Office are leading sources of information about property and casualty insurance market in the United States. Property and casualty insurance is a classification of insurance that includes both auto and home insurance.

That means your homeowners policy is a property and casualty policy, and ISO helps your insurance company evaluate risk.

The Insurance Services Office has expanded its services and began offering risk analytics and mitigation in diverse markets. ISO became a wholly owned subsidiary by Verisk in 2009.

ISO is a massive database that uses data to provide insight on the best practices for businesses to handle risk. It provides services for a variety of personal and commercial insurance companies. Generally, ISO services are information services.

For an insurance company, calculating risk is incredibly important. The more accurately it can assess the likelihood of a claim at a specific home and how much that claim will cost, the more accurate the premiums.

Failure to calculate risk properly can hurt an insurance company financially, and that can be passed on to the consumer in the form of annual premium increases.

The Insurance Services Office (ISO) gathers information about fire protection services in communities across the nation. It aggregates this information, classifies areas based on it, and then reports back to insurance companies.

The classifications are then used to place each home in a PPC when a homeowners application is received. It’s just one of the many pieces of information used to calculate your annual premium.

If you don’t notice the ISO trademark on your policy, make sure to ask your potential insurer where the policy language came from before you sign off.

How do companies use ISO protection?

Because a third party determines your protection class for property insurance, it is the same regardless of which insurance company you choose. Most companies use the ISO protection class list as part of their ratings.

Shopping around won’t change your protection class, but it can still save you some money because each company determines how it charges based on protection classes and other factors.

One notable exception to this rule is State Farm. The largest home insurer in the nation uses a proprietary fire protection class rating system that relies on its loss data.

You may be wondering how to do a fire protection class code lookup in your state. Unfortunately, there is no ISO fire protection class lookup by address available to the general public, nor is there an ISO fire protection class by ZIP code. The fire protection class database is only made available to insurers.

However, you can find out about your fire department protection class by calling your local fire department or asking your insurance company. Do a fire protection class lookup for Texas or a fire protection class lookup in Florida to determine how your state rules on different class designations.

What are the homeowners protection classes?

As we’ve already mentioned, there are ten protection classes, plus the sub-classes such as 1X, which is a downgrade from Class 1. ISO’s scoring system has a total of 100 points available based on their evaluation of the three categories above.

Using the 2018 ISO Public Protection Class Report, let’s look at how the points are distributed and what class those points will land you in.

Here’s how the points are distributed based on each evaluated factor.

| Factor | Available Points |

|---|---|

| SECTION 1 – Emergency Communications | TOTAL POINTS – 10 |

| Dispatch Circuits | 3 |

| Emergency Reporting | 3 |

| Telecommunicators | 4 |

| SECTION 2 – Fire Department | TOTAL POINTS – 50 |

| Community Risk Reduction* | 5.5 |

| Company Personnel | 15 |

| Deployment Analysis | 10 |

| Engine Companies | 6 |

| Ladder/Service Companies | 4 |

| Operational Considerations | 2 |

| Pump Capacity | 3 |

| Reserve Ladders/Service Trucks | 0.5 |

| Reserve Pumpers | 0.5 |

| Training | 9 |

| SECTION 3 – Water Supply | TOTAL POINTS – 40 |

| Credit for Supply System | 30 |

| Hydrant Size, Type, and Installation | 3 |

| Inspection and Flow Testing of Hydrants | 7 |

Now that we know how the points are assigned, what does a protection class rating of three, eight, or ten mean? The total number of points available is 105.5 due to the extra points for community risk reduction.

That score determines your protection class. Here’s how the points add up.

| Class | Points Range |

|---|---|

| 1 | 90 and above |

| 2 | 80–89.99 |

| 3 | 70–79.99 |

| 4 | 60–69.99 |

| 5 | 50–59.99 |

| 6 | 40–49.99 |

| 7 | 30–39.99 |

| 8 | 20–29.99 |

| 9 | 10–19.99 |

| 10 | 9.99 and below |

There is one more factor that can influence the points total, and that’s the divergence factor. This mathematical calculation adjusts the points based on the relative difference between the water supply and fire department scores.

And what about the split classifications? These refer to two of the significant factors: the fire department and the water supply. The first code in a split classification refers to the fire department rating, while the second refers to the water supply.

If your home has a fire department within five miles but doesn’t have a water supply within 1,000 feet, it will be classified as a 1/1X. The community is Class 1 for the fire department, but 1X for water supply proximity.

The X classification is one of the new PPC protection classes that debuted in 2014. Some classes, like protection class 8b, still exist, while others have changed. Nine as a secondary classification is now instead of the main classification with an x added.

Where the secondary classification was 8b, ISO now uses the leading number with a y added. 8b does still exist as a standalone classification, as does class 9.

The insurance company uses insurance protection class codes when calculating your rates or when deciding if they’ll insure you at all.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do I find the protection class of a property?

You might be wondering: What is the protection class of a building? What makes your home a protection Class 5 or a protection Class 8 or 10? Protection classes are assigned using a few pretty simple factors. These are the three main categories used to calculate a protection class and the amount of weight they carry.

| Category | Percent of Score |

|---|---|

| Fire Department | 50% |

| Water Supply | 40% |

| Emergency Communication | 10% |

Let’s take a closer look at what each of these means and what goes into determining a homeowners protection class.

Water Supply

Water is what fire departments use to put out fires, as we all know. But where does the water come from? Most areas rely on fire hydrants.

The biggest part of the water supply question is the distance from your home to a fire hydrant. Readily available water means the fire department can get right to putting out those flames.

ISO also considers the type, condition, maintenance, and distribution of hydrants. Overall, it’s a calculation of how much water is needed to put out a fire, where it’s located, and whether there is a risk that the water supply may be unavailable or insufficient.

Imagine the footage you’ve likely seen of the efforts to put out forest fires. Those fires are in remote locations, and water has to be brought in and in vast quantities.

Now, imagine a home in a remote location. The same problems apply, although you likely don’t need as much water to put out a fire in your home as you do with wildfire.

Emergency Communications

The faster you get a dispatcher on the phone, the faster a fire truck can be on its way to put out the fire in your home. That’s basically what emergency communications means, and not all communities have the same access.

ISO looks at things like the availability of telephone communications, the staffing of dispatch locations, and the quality of that dispatch in order to evaluate the communications.

If you live in a city where phone lines and cellular services are reliable and rarely go down, dispatchers are well trained, and their offices well-staffed, you’ll land in a higher protection class.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fire Department

Not all fire departments are equal and how your local department stacks up affect your protection class.

ISO looks at how well equipped the fire department is, where it’s located compared to your home, and how it is staffed.

A professionally staffed fire department with firefighters that are always on duty will respond more quickly and effectively to a fire call than a volunteer department might.

Newer and better equipment will also make a difference in the firefighters’ ability to quickly put out a fire.

Rural areas often have volunteer firefighters, and as this new report points out, it can be hard to keep enough staff.

The National Fire Protection Association (NFPA) tracks fire departments in the U.S. Here’s a look at some of their statistics on fire departments across the country, including career versus volunteer departments.

| U.S. Fire Department Key Info | Details |

|---|---|

| Total firefighers | 1,115,000 |

| Career firefighters | 370,000 |

| Volunteer firefighters | 745,000 |

| Number of fire departments | 29,705 |

| Percent of fire departments that are career/mostly career | 18% |

| Percent of U.S. population protected by career/mostly career fire departments | 68% |

Fire department factors are the big ones. As noted above, the fire department’s factors make up 50 percent of an area’s total score. That means it’s half of the reason for your protection class.

There are many factors regarding the fire department and its response time that can affect a fire’s outcome, and they can get very detailed.

So what does this all mean in simple terms?

As a rule of thumb, if you’re less than 1,000 feet from a fire hydrant and within five miles of a fire station with a full-time, professionally staffed team, you’re going to be in good shape when it comes to protection class.

If you do not have a fire hydrant anywhere near your property and the closest fire department is 12 miles away and is staffed by volunteer firefighters, you are likely in Class 9 or higher.

Of course, there are a lot of areas that fall somewhere in between these two examples.

ISO uses a point system to determine which class each area will fall into and adds up those points after taking a detailed look at each of the three significant factors above.

This results in 10 protection classes, along with the sub-classes and the possibility of split classifications.

Why do fire protection classes matter?

Homeowners insurance companies, as we discussed above, base their homeowners insurance rates mainly on risk. Let’s say you’re taking out an insurance policy on a home that would cost $200,000 to rebuild from scratch.

The insurance company calculates a rate based on the risk they’ll have to pay to rebuild or repair it.

One of the basic principles insurers follow with their pricing is charging more money to those who present a higher risk of filing insurance claims, especially a large claim.

According to the Insurance Information Institute, fire and lightning are the most expensive because of insurance losses.

In 2017, 35.1 percent of home insurance losses were related to fire and lightning. Between 2013 and 2017, the average cost of a claim was $63,322.

The longer a home burns before the fire department shows up, the more your insurer is going to have to pay for repairs.

The higher your protection class, the longer your home would theoretically burn before they arrived.

Consider the difference between a home in a city and a home far from any towns in a remote area, where there are more challenges for firefighters responding. Both houses have an electrical fire.

When that home in the city catches fire, it’s likely to be noticed and reported right away, even if the owner isn’t home. The fire department, which is nearby, arrives quickly.

They access the readily available water supply from the fire hydrant, and soon the fire is out with the damage minimized.

Imagine that same fire starting in our remote country home. If no one is home, the fire could burn a long time before it’s even noticed.

Even if someone is there, the fire department will take a lot longer to arrive and need a water supply other than a fire hydrant. It will take longer to put that fire out, resulting in greater damage.

A fire goes from a single flame to a large fire in about 30 seconds. That makes the time it takes to notify the fire department and their arrival time vital.

The odds of a remote home being destroyed by fire are much higher than a city home, and the damage is likely to be much more extensive.

That’s why the remote home will have a higher protection class rating. It may even be a Class 10 if it’s far enough away from services or the services aren’t available.

The protection class allows the insurance company to give a data-based rating of how much they stand to pay out if a particular home was to catch fire.

Because they stand to pay out more in a claim, they’re going to charge you a higher rate for your insurance.

Can an insurance fire protection class change?

The ISO reviews fire protection codes and insurance classes annually, so your community’s class can go up or down if something in your rating factors has changed.

Improvements in the fire department can bump you up a class, while a loss of services can drop you down.

Most areas don’t see significant changes in protection classes, at least not sudden changes. However, working to improve fire suppression in a community can greatly improve your protection class over time.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to find Protection Class 10 homeowners insurance?

Getting homeowners insurance for a home that is in a higher protection class is difficult. In the top two protection classes, it’s even more challenging. If you’re having a hard time getting the coverage you can afford, you have a few options.

Your first action should be to reach out to an insurance agent that specializes in high-risk properties and can point you in the direction of an insurance company that offers that sort of policy.

There are plenty of insurance companies out there that are willing to insure homes the big companies might turn down.

You may have to consider a different type of coverage if your home doesn’t qualify for a standard home insurance package policy, such as a named perils vs. all-risk homeowners policies.

Make sure you read all of the fine print and know what is covered and what is not, regardless of the policy you choose.

In the direst of situations, when you’ve been turned down for insurance at multiple companies, including specialty insurers, you may be able to get coverage with a FAIR plan. Not all states have one, but many do.

These plans provide coverage to homeowners that have been unable to secure a homeowners policy on the open market.

Homeowners Protection Classes: What’s the bottom line?

The protection class in which your home is located will affect your homeowners insurance rates, possibly by quite a bit. If you’re wondering about protection classes in your state, you can find out from your state’s insurance department exactly how classes work in your area.

While there’s nothing you as an individual can do to change your protection class, you can still find ways to lower your homeowners insurance rates before you buy home insurance. (For more information, read our “How to Buy Homeowners Insurance“).

Look at other options for getting a better rate, including policy discounts. Install a home security system, particularly one that has a fire alarm monitoring system.

Your insurance company will offer you an insurance discount for this, and you’ll also reduce the possibility of a catastrophic fire claim by ensuring a fire is caught and put out quickly.

Of course, shopping around is always the best way to save. Insurance companies determine their rates for each particular risk factor, so it’s worth taking the time to shop around and compare prices.

Whether you’ve got protection class 10 or protection class 1 homeowners insurance, you can use our free comparison tool to find the lowest homeowners insurance quotes in your area simply by entering your ZIP code. (For more information, read our “The Five Most Common Homeowners Insurance Claims“).

Frequently Asked Questions: Homeowners Insurance Protection Class

To wrap up this comprehensive guide, we’ll answer a few frequently asked questions.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – How do you find the protection class of property?

It won’t be easy to find. However, your home insurance provider has tools that will help you find your protection class.

#2 – What do home insurance companies use to find homeowners insurance protection classes?

Home insurance companies used the ISO tool, which allows them to use your ZIP code to determine your property’s protection class.

#3 – Can you improve the homeowners insurance protection class?

Yes, but you can’t do it alone. Protection classes improve when the entire community has consistent and effective communication with emergency personnel such as fire departments, fire safety education, and water supply organizations.

References:

- https://www.fayetteville-ar.gov/DocumentCenter/View/15775/2018-ISO-Public-Protection-Classification-Report/”

- https://www.nfpa.org/News-and-Research/Data-research-and-tools/Emergency-Responders/US-fire-department-profile

- https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

William Lemmon

Principal Broker

William Lemmon has been a licensed insurance agent for over 12 years. He is the principal broker and owner of Broadway Insurance Services in Los Angeles, CA. He works one-on-one with clients to create personalized plans that minimize risk and maximize savings. Being one of the foremost authorities on Airbnb and home-sharing property insurance, Lemmon offers his clients first-hand guidance on how t...

Principal Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.