Drivewise App from Allstate: Earn Points and Cash Back for Safe Driving

The Allstate Drivewise app will give you rewards and cashback based on your safe driving habits. Learn more about how the Allstate points system works in our Allstate rewards review below.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Allstate’s Drivewise app allows you to earn cashback and rewards for safe driving behavior. With this app, Allstate rewards points to cash to its users. Best of all, it’s available to anyone, not just those who have car insurance from Allstate.

Drivewise is a telematics program (also called usage-based programs). Almost all of the major insurance companies have one, but they all go by different names. Some use mobile apps and others use a plug-in device.

Unlike many other telematics programs that simply offer you a discount on your insurance premium, Allstate Drivewise is also a rewards program.

Keep reading this Allstate Drivewise review to learn more.

How does Drivewise work?

First off, Drivewise is just a smartphone app that you can download for iOS or Android, unlike the similar but much more involved Snapshot from Progressive. So the app is available on the majority of mobile devices.

Drivers’ phones act as monitoring devices, ensuring you operate your vehicle at safe speeds and avoid common high-risk driving behaviors.

Once you download the app, simply keep it running in the background and drive as you normally would. You don’t need to turn it on and off when you start and stop trips.

It will automatically detect a trip is occurring as long as you drive at least 20 mph for a short distance and your phone has location services enabled with at least 25% battery power (that power thing might be an issue for some heavy phone users).

As you drive, you’ll be given feedback from the app (such as in-trip alerts if you exceed 80 mph or hard braking incidents) while earning rewards that can be used to purchase select merchandise, gift cards, and more.

If you’re an Android user, you can activate an optional service that automatically texts others to let them know you’re driving (this is great for making our roads safer!).

And after each trip, you’ll get insights into your driving patterns and tips on how to drive safely.

If you’re an Allstate customer, your rates will not go up as a result of your driving, they say. However, Allstate customers “can get cash in their pocket when they add Drivewise to their policy.”

Apparently, you get up to 10% off your auto insurance premium just for using the Drivewise app, and up to 20% off your policy every six months based on your safe driving in the form of a check or policy credit. This Drivewise discount is on top of other discounts for things like also having Allstate’s home insurance.

I believe you need to call your Allstate agent to sign up for the Drivewise service to get the discount, though it may be automated via the app as well if you indicate you’re an existing Allstate customer. But if you’re uncertain, just call Allstate.

Non-Allstate customers can use Drivewise too, but they simply earn points as no discount can be given on a non-existent policy with the insurance company.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do you earn points for Allstate Drivewise rewards?

The Allstate app rewards you for the following safe driving habits:

- Safe speeds (avoiding driving over 80 mph)

- Safe stops (avoiding hard braking)

- Safe hours (avoiding late-night driving)

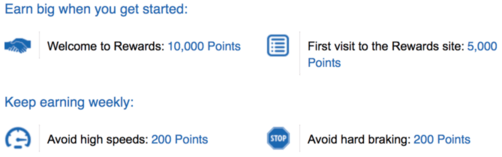

To get started, Drivewise customers get 10,000 Allstate Rewards points just for downloading the Drivewise app and completing enrollment, and another 5,000 for visiting their rewards site for the first time.

You can also complete “safe driving challenges” to earn even more points. For example, you can snag another 200 points each for taking safe trips, avoiding high speeds, and avoiding hard braking.

If there are multiple drivers in your household, they too can earn rewards via the Allstate rewards check.

Eventually, you can use those points to buy stuff through the Allstate store from companies like Nike, Oakley, Samsung, etc. Or take part in auctions, local offers, and daily deals.

It’s unclear how valuable they are on a per-point basis, but the good news is the Allstate Rewards points do not expire.

What is Allstate doing with the Drivewise app data?

The company actually collecting the data is called Arity, which isn’t an insurance company, but rather an analytics company.

They capture all types of information, including miles driven, acceleration data, braking behavior, cornering, speed, trip start and end time, risk hours (rush hour or off-peak), and route information.

Our assumption is that this data is being collected to better determine driving behavior and analyze certain risks. They’re basically giving you points in return for invaluable data, whether you have an auto insurance policy with Allstate or not.

This information can help companies like Allstate better calculate premiums, discounts, and rewards for driving performance.

It may actually be interesting to see all that data to learn how you drive and what you might be doing wrong (or could improve on).

Oh, and the Drivewise app will also help you find your car if you can’t remember where you parked for whatever reason.

If you practice safe driving habits, you can earn Allstate Rewards points, which as mentioned can be redeemed for gift cards from a variety of retailers, or for merchandise.

Where is the Allstate safe driving app available?

It should be noted that the Allstate Drivewise app is not available to drivers nationwide.

It is currently only available in the following states: Georgia, Idaho, Iowa, Kansas, Maine, Montana, Nebraska, New Hampshire, North Dakota, Rhode Island, South Dakota, Vermont, Virginia, West Virginia, Wyoming, and DC.

The state list seemed to grow larger at one point and then shrink again, per info pulled from their website, though we’re not sure why. Perhaps some extensive testing is happening.

Either way, notably missing are highly populated states such as California, Florida, New Jersey, New York, and Texas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How else can you save money with Allstate insurance?

In addition to Drivewise, Allstate offers a number of auto insurance discounts that can be applied to your policy. These include:

- New car discount

- Safe driver discount

- Multi-policy discount

- Good student discount

- Early signing discount

- Paperless billing discount

If you are eligible for several of these discounts, you could significantly lower your insurance rate with Allstate.

Read more: Allstate Auto Insurance Discounts

Allstate’s Drivewise: What’s the bottom line?

As mentioned, you don’t need to get a quote from the Allstate Insurance Company, nor do you need to purchase their insurance to participate in Allstate Rewards. Just know that they might be using your driving data for who knows what.

Additionally, Drivewise is an optional feature for Allstate drivers. You can add it if you want to save some money on your policy – just understand that they probably won’t reward bad driving habits.

Personally, I’d rather my driving habits not be tracked constantly, even though I’m a responsible driver. It’s the continuous tracking (the device in my car, knowing the miles per day I drive, where I go) that doesn’t sit well for one reason or another.

The cool thing is we can learn what’s frowned upon by Allstate to better understand how to stay safer out there. For some, it’s impossible to change the number of miles driven or the miles per day they drive (or the risk hours).

The biggest takeaway in our control seems to be hard braking incidents, so if we can avoid that, we might keep ourselves out of a lot of trouble and potentially save on car insurance.

In other words, always give yourself plenty of space between yourself and the driver in front of you, whether you have the device installed or not.

Be sure to compare insurance rates after factoring in all these driver discounts to see which company offers the best coverage at the lowest price.

Read More: The Comprehensive Allstate App Review

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.