Hazard Insurance vs. Homeowners Insurance

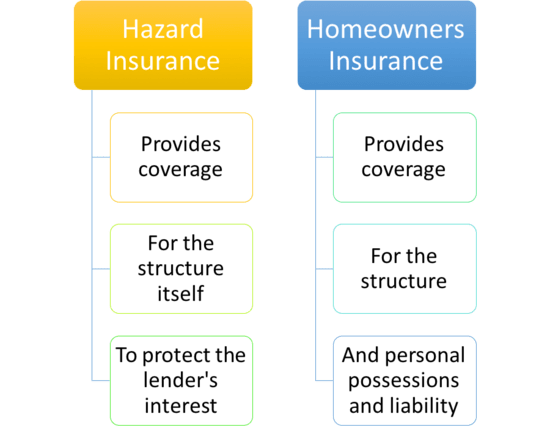

Hazard insurance is required by mortgage lenders, but when it comes to hazard insurance vs. homeowners insurance, both policies cover very different things. Hazard insurance covers the structure itself and none of your personal belongings. You will need a homeowners insurance policy to cover your home and your personal items within it. Learn more about the differences between hazard insurance vs. homeowners insurance below.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

So you’re finally ready to buy your dream home, or perhaps that dream investment property.

Your credit has been checked, your down payment and assets have been meticulously reviewed, and your employment has been verified by the underwriter.

It’s almost time to close on your loan, thank goodness!

This is around the time when your loan officer tells you to it’s time to get your insurance lined up. Specifically, he or she tells you to get a ‘hazard insurance policy’.

“Err…what?” You might begin to wonder if you’re being taken for a ride. “I thought I needed a homeowners insurance policy for my property. It is, after all, going to be my home. What is a hazard policy? I’ve never heard of such a thing!”

A hazard policy does exist, but it’s a little different from a homeowners policy. Keep reading to discover the difference.

What exactly Is hazard insurance?

While homeowners and hazard insurance might be used interchangeably, especially by loan officers and mortgage brokers who aren’t insurance specialists, we’re actually talking about two different types of coverage here. Hazard insurance only protects the structure itself, aka the mortgage lender’s interest in your property.

Hazard insurance is an absolute requirement when purchasing a new home with a mortgage loan.

It is all too obvious that you don’t actually ‘own’ your home when you sign on the dotted line for that 30-year mortgage.

The reality is that the bank owns your home until the mortgage is paid off.

While the bank is nice enough to lend you a couple hundred thousand dollars, they certainly would not give you a dime unless you have insurance in place to protect ‘their’ investment.

Put another way, your bank thinks you might not pay them back if your new home burns down, and an insurance company doesn’t swoop in to rebuild it for you.

Without hesitation, you contact your insurance agent and ask about getting a hazard insurance policy.

Long story short, you wind up getting a homeowners insurance policy, and your lender is ready to close your loan.

This may be the point where you wonder why your loan officer asked for hazard insurance, and your agent never once used the word ‘hazard’, but referred to your policy simply as ‘homeowners insurance’.

You might even be thinking you don’t have the right kind of insurance. The good news is you’re all set, because a homeowner’s insurance policy not only covers the requirements of hazard insurance, but also goes far beyond that.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How is hazard insurance not homeowners insurance?

Careful review of the information above will show you that your bank is ONLY concerned with insuring their asset, which is the physical structure you live in, that they lent you the money to purchase.

The key differences here being that hazard insurance is designed to cover only the structure your bank owns until you pay them back.

So if your home burnt down because of a volcanic eruption, or was demolished by a tornado, a hazard insurance policy would pay for the cost to repair or rebuild the structure (known as a dwelling in insurance lingo).

Whether you decided to stay and rebuild or move to another state after the damage occurred, your insurance company would pay to have the home rebuilt and your bank would still have an ‘asset’ to sell to someone.

You may be wondering, why you would need any insurance beyond the basic hazard insurance policy to cover the dwelling you live(d) in. (For more information, read our “What is a dwelling fire policy?“)

Well, what about all of your personal possessions and the liability you assume by owning property?

That’s right…a hazard insurance policy does absolutely nothing to cover your personal possessions or your assumed liability for owning a home. In the event of any natural disasters, the hazard policy would only offer dwelling coverage, because that’s what the bank is most interested in protecting.

You would need a homeowners or landlord’s insurance policy to insure you and your personal property against these perils. (For more information, read our “Named Perils vs. All Risk Homeowners Policies“).

Read More:

- Can I get landlord insurance for my home if I move out?

- Why is landlord insurance more expensive than homeowners?

While your loan officer may not sit you down and explain this to you in detail, the insurance industry has got you covered, which is why personal property coverage usually comes with a homeowners policy. Granted, there might be policy limits, but those are for another time.

We won’t spend a lot of time going through the details here, but just know that your lender will give you the money to purchase a property whether you insure your interests (personal property and liability) or not.

Ultimately, they are only concerned with their asset, not your assets.

This is why a lender forced insurance policy doesn’t cover your personal property or liability.

This is the insurance your bank will put on your home if you don’t maintain coverage on your home. Your mortgage company wants to be just as prepared as you would be against any accidental damage done to your home, though the reasons may be slightly different.

[Types of homeowners insurance.]

Why is homeowners insurance what you actually need?

Your mortgage lender doesn’t specialize in insurance. They simply need to ensure that your property is properly insured in case something happens that affects their financial interest in it. Your insurance agent or company will know what type of coverage you need. This is why it’s for the best that you be cognizant of what is included in your insurance costs, and what your coverage limits are.

However, there’s really no need for concern here, as there aren’t really any insurance agents out there who can offer a true hazard insurance policy.

It comes down to semantics, but at the end of the day, insurance companies are going to offer you a homeowner’s insurance policy.

Your basic homeowner’s policy is designed to include coverage for your personal property, liability, loss of use and other basic types of coverage the average homeowner needs. If the cost of homeowners insurance is something you’re concerned with, or you simply want to know what the limits are, you can always get in touch with someone to go over the details. (For more information, read our “The Five Most Common Homeowners Insurance Claims“).

Again, no need for concern here, as homeowners insurance is exactly what you need to be as protected as possible.

Your lender doesn’t specialize in insurance; they specialize in closing your loan. They’re going to care quite a bit about the financial protection of their – err, your property.

There is no way a lender can force you to buy insurance for your home’s contents and your liability…so they don’t. They simply require a hazard insurance policy.

Don’t give it a second thought. Insurance companies don’t even really sell ‘hazard’ insurance.

The only way you’ll wind up with this inadequate coverage is if you don’t pay your insurance premium and your mortgage lender places your insurance.

Even then, you’ll receive a letter from your lender in the mail that specifically details the fact that they are forcing you into this type of policy, and that they’re going to charge you a lot of money for it, even if it’s additional coverage you don’t need or want.

And that it only covers the actual structure they own…heck, they’ll even tell you to go get a regular homeowners insurance policy, which is really what you need.

Tip: The premium for lender forced coverage is simply added to your monthly mortgage payment. If you don’t keep up with those payments, you’re on your way to foreclosure. (For more information, read our “Switching Homeowners Insurance Companies When You Have a Mortgage“)

Because there are various types of homeowners insurance, it’s always a good idea to stay current and up to date with your insurance provider on what you have and what is covered. Think of it like auto insurance – you want to know that your property is protected, be it by natural events or not. And if you’re still worried you don’t have sufficient coverage, don’t be afraid to shop around, and talk to various companies.

But at least now you know the difference between hazard insurance and homeowners insurance. While these policy types may have seemed confusing at first, that can simply be attributed to the fact that the information is usually coming from two different sources. Always cross reference, and if you still have questions, always find the answers before making your financial decisions.

Read More:

- Do I have to tell my homeowners insurance company I have a dog?

- What does homeowners insurance cover?

- Who is covered under homeowners insurance?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.