Top Homeowners Insurance Companies in Texas

The top homeowners insurance companies in Texas are State Farm, Farmers, and Allstate. State Farm holds nearly one-third of the market share in Texas (28.8 percent), but being the biggest doesn’t mean you’re paying the best rates. Use our free tool below to compare quotes from top home insurance companies in Texas and find the best fit for you.

UPDATED: Dec 16, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Dec 16, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 16, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Dec 16, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

If you own property, you’re going to need a homeowners insurance policy. Whatever you call it, dwelling coverage, personal property insurance – it boils down to a homeowners policy being absolutely necessary. Needless to say, most homeowners are going to be preoccupied with insurance costs and what types of coverage they’re going to need.

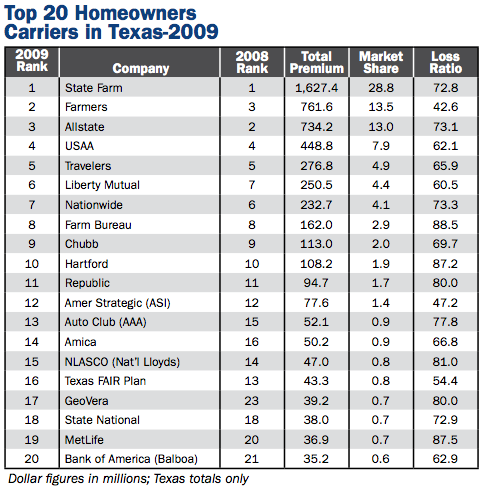

Below is a list of the top 20 homeowner’s insurance companies in Texas during 2009, based on written insurance premium.

Keep in mind that these companies aren’t necessarily the top rated or the ones you should go with – they’re just the most frequently used by Texas homeowners. In order to find yourself average rates on auto policies that would be suitable for your personal needs, you’ll have to investigate the market yourself. For comparative purposes, reaching out to numerous companies is generally better than looking at only one or two.

As you can see, State Farm was the top homeowner’s insurance provider in Texas in 2009 (the most recent data available), according to a report from the Independent Insurance Agents of Texas.

The company grabbed 28.8% of the market share with $1.63 billion in written premium, more than doubling second-ranked Farmers, who snagged 13.5% of the market share with just over $761 million in written premium.

Allstate took the third spot with 13% market share and $734 million in written premium, followed by USAA, with 7.9% market share and $449 million in written premium.

Rounding out the top five was Travelers, with 4.9% market share and $277 million in written premium.

There were a number of other notables are in the top 20, including Liberty Mutual, The Hartford, AAA, Amica, and MetLife.

As mentioned earlier, this list isn’t necessarily a gauge of quality, but more about market share, and the names an independent insurance agent may throw your way. Also mentioned above, the cheapest rates do not guarantee you excellent service. For that, you’re going to have to dive into the world of customer reviews, and financial strength investigations. (For more information, read our “Top 10 Lies Told By Insurance Agents and Their Customers“)

Read More: Top Ten Insurance Companies in the United States

These factors will vary from company to company, but they are just as important as making top of the charts. You want whatever provider you choose to have excellent customer satisfaction and financial stability, so that they’ll be able to help you for a long time.

The 2009 homeowner’s loss ratio (amount of money paid out in insurance claims versus earned premium) of 67.1% was significantly better than the Hurricane Ike-driven 129.1% seen in 2008.

But there’s still a long way to go to get back down to 2005-2007 levels, which were between 33-56%.

Because of the abundance of natural disasters in Texas, the cost of homeowners insurance is naturally going to be more expensive there than in other parts of the country.

Since this is true, it’s smart to know what policy service options are out there. There are many tools, agents, and websites that you can turn to if you’re looking for homeowners insurance quotes.

Read more:

- How are homeowners insurance rates determined?

- Top Commercial Auto Insurance Companies in Texas

- Types of Homeowners Insurance

(photo: westtexan)

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.