Top Mortgage Insurance Companies

The top mortgage insurance companies in the U.S. are MGIC Investment Corp., PMI Group, and AIG. Together, these three companies make up more than half of the mortgage insurance market in the country. Mortgage insurance companies exist to protect lenders if a homeowner defaults on a mortgage loan.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Sep 14, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 14, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Mortgage insurance protects lenders when homeowners default on mortgage payments

- Homeowners are required to buy mortgage insurance if they put down less than 20% or have less than 20% equity in their home when refinancing

- The top mortgage insurance companies can offer affordable rates, but you’ll get the best deal when you compare multiple insurance companies online

Mortgage insurance, also known as private mortgage insurance or PMI, is a type of insurance that is required on all residential mortgages with a loan-to-value above 80%.

Mortgage insurance is not a type of homeowners insurance. Instead, it protects the lender in cases where homeowners default — it does not protect the homeowner if they start missing monthly payments on their mortgage.

Just as consumers need protection, homeowners insurance companies do as well to avoid damage being done to their assets. This is why this type of mortgage insurance exists.

Today, we’re introducing you to some of the top mortgage insurance companies that provide dwelling coverage services.

What are the top mortgage companies?

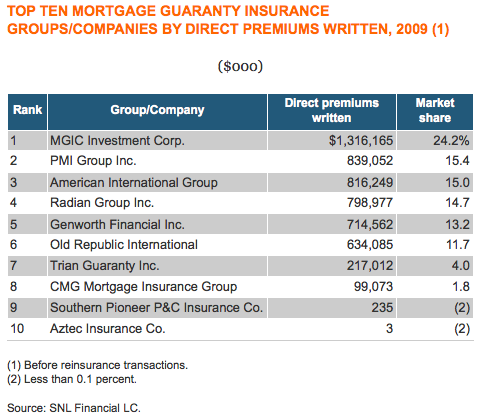

Last year, MGIC Investment Corp. was the top mortgage insurance company in the United States, with $1.32 billion in direct insurance premiums written. The Milwaukee-based insurance company claimed a healthy 24.2% of total market share and nearly doubled the volume of the second-largest mortgage insurer.

PMI Group Inc., the second largest mortgage insurer, wrote $839 million in premiums and grabbed 15.4% of the market share.

American International Group (AIG) was a close third with $816 million in insurance written, claiming 15% of market share.

Radian Group and Genworth Financial rounded out the top five with totals not far off that of PMI Group and AIG.

Then things dropped off considerably, with the tenth mortgage insurer on the list underwriting only $3,000 in business.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why mortgage insurance?

Remember, mortgage insurance is required on all residential mortgages with a loan-to-value above 80%.

In other words, if you put down less than 20% or have less than 20% equity in your home when you refinance, your bank or lender will require you to take out mortgage insurance.

This is great for lenders, in the instance that homeowners default, especially on high-value homes. But it’s a costly investment for homeowners. However, from the lender’s point of view, these types of coverage can be incredibly helpful. If you still have questions, or you’re wondering whether you’re paying for it on your homeowners policy, you can always speak to your insurance agent about it.

Comparing the Top Mortgage Insurance Companies

Even though this may not fall into the common types of coverage searched for, mortgage insurance is still a necessity. If you need to look into these coverage options, there are many mortgage insurance companies out there. You don’t necessarily have to focus on the top mortgage insurance companies, though they do tend to have a good reputation on their side.

What you could do is use online comparison tools to compare the top mortgage insurance companies in your area. Use our free quote comparison tool above to ensure you make confident investment decisions and find the best, most affordable mortgage insurance rates. (For more information, read our “Top Ten Insurance Companies in the United States“)

Read more:

- Is homeowners insurance included in the mortgage?

- Switching Homeowners Insurance Companies When You Have a Mortgage

- Top 10 Insurance Complaints

- Top 10 Homeowners Insurance Companies

- Top Homeowners Insurance Companies in Texas

Frequently Asked Questions

What is the world’s top mortgage insurance company?

The top mortgage insurance company is MGIC Investment Corporation.

What is the world’s largest mortgage lender?

Rocket Mortgage is the largest mortgage lending company in the U.S.

Who provides PMI insurance?

Along with the top mortgage insurance companies on our list, Radian, Essent, and United Guaranty are also strong mortgage insurance providers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.