Which insurer spends the most on advertising?

The fact that several billion (with a “B”) advertising dollars were spent by just a few insurance companies reveals that the insurance industry is extremely profitable and competitive. Which insurer spends the most on advertising?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

As individuals, we’re always more in tune with what’s going on in our own neck of the woods. This could include news, companies, and much more. Chances are you can recite the tag line from at least one local personal injury attorney. When it comes to auto insurance, it’s a little different, however. You might know some local names, but many auto insurance companies are national brands, as well.

You know them because you find them in an online search or see an insurance commercial. The advertising industry makes billions off of companies like Geico, Liberty Mutual, and Progressive. This is without counting specialized local brands. While there are hundreds of auto insurance companies in the US, a select few hold the high majority of the market share.

If you’re in the market for new auto insurance, begin your browsing of affordable options today by entering your ZIP code into our free online quote tool.

How do insurance companies choose their target audience?

Have you noticed that when you become interested in purchasing a particular model of car, you tend to see more of them on the road?

This holds true whether you’re looking to buy a 1980 Chevy Malibu or a 2011 Infinity G37. It just tends to be on your “radar.”

Advertisers love this. This concept means they can subliminally fill your brain with their message without coming across as annoying or desperate for your business. Some larger companies reach out to anybody and everybody. The average insurance provider has to work within a limited budget and therefore choose where they spend their ad dollars wisely.

Insurance professionals are all too aware of this. They have to contend with the fact that the largest insurers in the U.S. occupy what seems like 95% of all advertising space. This frequency of advertising tends to hold firm regardless of entertainment medium: television, radio, and the internet. There seems to be no escape.

Here’s a challenge for you. Try to count the number of Geico, State Farm, Progressive, Allstate, and Farmers Insurance ads you hear or see in one day (let’s throw in 21st Century for good measure). You’ll quickly see what we’re referring to when it comes to insurance companies and their advertising.

That said; let’s take a look at who is spending what to convince us they are better than the next insurer.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much did the top spenders in insurance spend on advertising?

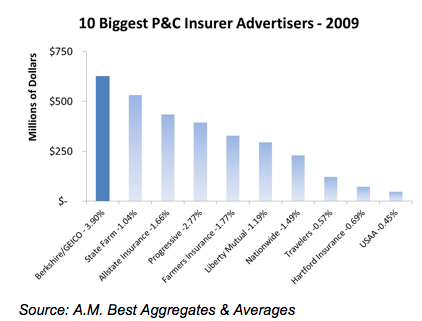

While Warren Buffet recently detailed in a letter to Berkshire Hathaway shareholders that his company spent nearly $900 million in advertising in 2010, let’s look at the 2009 numbers (the most recent available) published by AM Best to see where the top 10 insurers stood.

Warren Buffet’s Berkshire Hathaway/Geico’s marketing budget came in near the $600 million dollar range, followed closely by State Farm with an advertising budget of over $500 million. Rounding out the top three was Allstate Insurance, which appeared to spend slightly less than $500 million dollars.

Progressive at nearly $400 million, Farmers Insurance at around $350 million, and Liberty Mutual’s advertising budget is at roughly $300 million, meaning these providers are no slouches when it comes to throwing money at the highly competitive insurance market.

What does this really mean?

The fact that several billion (with a “B”) advertising dollars were spent by just a few insurance companies reveals that the insurance industry is extremely profitable and competitive.

It may also tell us that the products don’t speak for themselves. You may have noticed a never-ending list of famous actors or athletes telling you they love whichever company they are pitching.

The reality is companies like State Farm, Geico, and Farmers Insurance don’t carry products that can adequately insure the people who represent them through advertising.

That alone should make you skeptical of the “not so sincere” pitches of the rich and famous for these insurers.

For example, Lebron James very likely does not insure his home(s) with State Farm. Let’s just leave it at that.

It may be a good idea to ask yourself if you’ve chosen Geico (or another top brand) over other similar insurance companies before and ended up paying more just because it was on your radar.

Remember, it’s recommended that you compare multiple insurance quotes and shop around with an independent insurance agent to ensure you get the best coverage at the lowest price. Get started looking for affordable insurance coverage now by entering your ZIP code into our online quote tool.

Read more: Farmers Insurance Insurance Review

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.