Independent Agent vs. Captive Agent

What's the difference between an independent and captive agent? You visit your local independent agent armed with the necessary personal information to obtain a car insurance policy. By nature, a captive agent only sells insurance for a single company. An example of a captive agent would be State Farm. All of the steps would be the same, up to the point where you receive your quote.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Sep 14, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 14, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

There are many ways to purchase a personal insurance policy these days, whether it be online, over the phone, or in person. Captive and independent insurance agents sell countless policies to homeowners, car owners, and many others looking for reliable insurance products. If you look into the full range of insurance products sold on the market today, you can buy insurance for just about anything. The exact rules of engagement can change, though, even within the same type of insurance.

Ultimately, you will obtain insurance directly from an insurance company or through a licensed insurance agent. When you go to Geico’s website, you’re getting quotes under their license. If you get quotes from independent insurance agents, they should be licensed in your state.

To drill down even more, there are multiple types of insurance companies and insurance agents to choose from. For example, the agent quoting your homeowners policy would be licensed in property and casualty. Life insurance agents should be licensed in the life insurance industry. Generally, independent agencies also have to get state licensing in specific areas like life, property, and casualty.

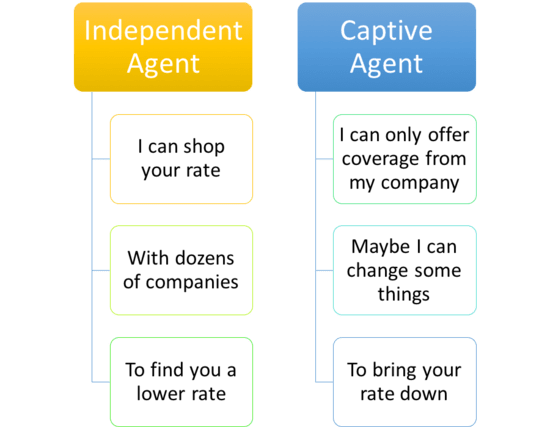

For the purpose of this discussion, we’re going to look at the benefits of using an independent agent vs. a captive agent.

What are the benefits of an independent insurance agency/ agents?

In this day and age, it’s all about choices and options. This is where the value of an independent agent comes to light. Put simply, they have the ability to offer more choices than a captive agent. (For more information, read our “Types of Insurance Agents“).

Independent agents represent, in some cases, over 100 insurance companies. They may also have different types of agents with a range of licenses and specialties in commercial or personal. So you can find insurance carriers to meet a diverse range of needs in one place.

This means they can look at your personal situation and shop your needs with several dozen insurers to make the best recommendation for you.

Each insurance company will have different rates, liability limits, and in some cases, coverage types, so it’s important to look at them all.

Additionally, one insurer might have spectacular pricing in your area that is much lower than the competition. When you go with independent insurance agents, you will still qualify for multi-policy discounts and other similar benefits if you get multiple policies with a single insurance company. An independent agent can present different options if multiple insurance providers offer better options for you.

With captive agents, you could miss out on smaller companies, in-depth knowledge, and many other opportunities.

Let’s look at an example of a potential insured shopping with both an independent agent and a captive agent.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Independent Agent:

You visit your local independent agent armed with the necessary personal information to obtain a car insurance policy.

After answering all of the questions needed to properly fill out an application, the agent “shops” your application to three different companies that typically accept risks of your nature.

Here are the potential results:

Company A: $750 for a one-year policy

Company B: $918 for a one-year policy

Company C: $430 for a six-month policy ($860 for one-year of coverage)

Assuming the limits and coverage types are similar, your agent may recommend Company A, as that policy would save you $110 over the course of one year.

If you agree and proceed, the agent will bind your policy and you will be covered.

Captive Agent:

In contrast to the example above, let’s look at the captive insurance agency. By nature, a captive agent only sells insurance for a single company.

An example of a captive agent would be State Farm. All of the steps would be the same, up to the point where you receive your quote.

State Farm: $814

As you can see, State Farm is not the highest priced policy versus the independent agent’s options. In fact, they are cheaper than two of the three.

Here is where you will be limited though. The captive agent is not going to offer you any more quotes. They don’t have the option to do so. Unless you get quotes from another agent, you have no way of knowing how State Farm actually stacks up against its competitors. Captive agents are also not able to search for the right company. They can only customize that one company’s coverage within the company’s limits.

If this were the only place you shopped for insurance, you would be led to believe that this is the best rate available to you in the above example. You would be overpaying for the same coverage by $64 compared to Company A offered by the independent agent.

Independent agents may also have a leg up on the renewal process as well. Imagine in the example above that State Farm was the least expensive policy when you purchased coverage.

What would happen the following year when your policy renewed? It’s possible State Farm had to increase their rates.

If you called your agent to see about getting another insurance quote, you’d be out of luck. They can only sell you a policy from their company.

You will likely hear “rates are going up everywhere because of the economy.” Take a break to roll your eyes if you’ve already heard that one before.

Additionally, some agents may offer to reduce coverage as a means to lower your premium. Unfortunately, this could leave some customers without the coverage they need. Because of their quoting limitations, this may be more tempting amongst captive insurance companies.

To a certain degree, every insurance agent is obligated first to the insurance carriers. They have to provide the right information to allow insurers to issue an accurate quote. If a captive agent cannot beat the other prices and recommends lowering your coverage, they are looking out for their own checkbook. Unfortunately, this can directly conflict with consumer interests.

Of course, the odds your agent would tell you to shop with another company are nil, as they would not receive a commission from that sale.

On the flip side, what if your policy premium goes up with an independent agent?

Well, the independent agent has the ability to “re-shop” your rate with any of the companies they represent and move your policy if necessary.

The independent agent can ensure you’re getting the best deal available each and every year. Just make sure your independent agent binds your policy with a stable, highly rated insurer.

There is something to be said for service. I’ve heard complaints about service from both large captive agent companies and companies who use independent agents to sell their product.

Don’t let anyone convince you that if you don’t go with one of the well-known national carriers that you’re risking anything. It simply isn’t true.

Every insurer operating in every state is watched by an associated State Department of Insurance to ensure their business practices are up to snuff.

Don’t let a multi-million dollar national advertising campaign be your only guide for information regarding your insurance choices.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.