Post

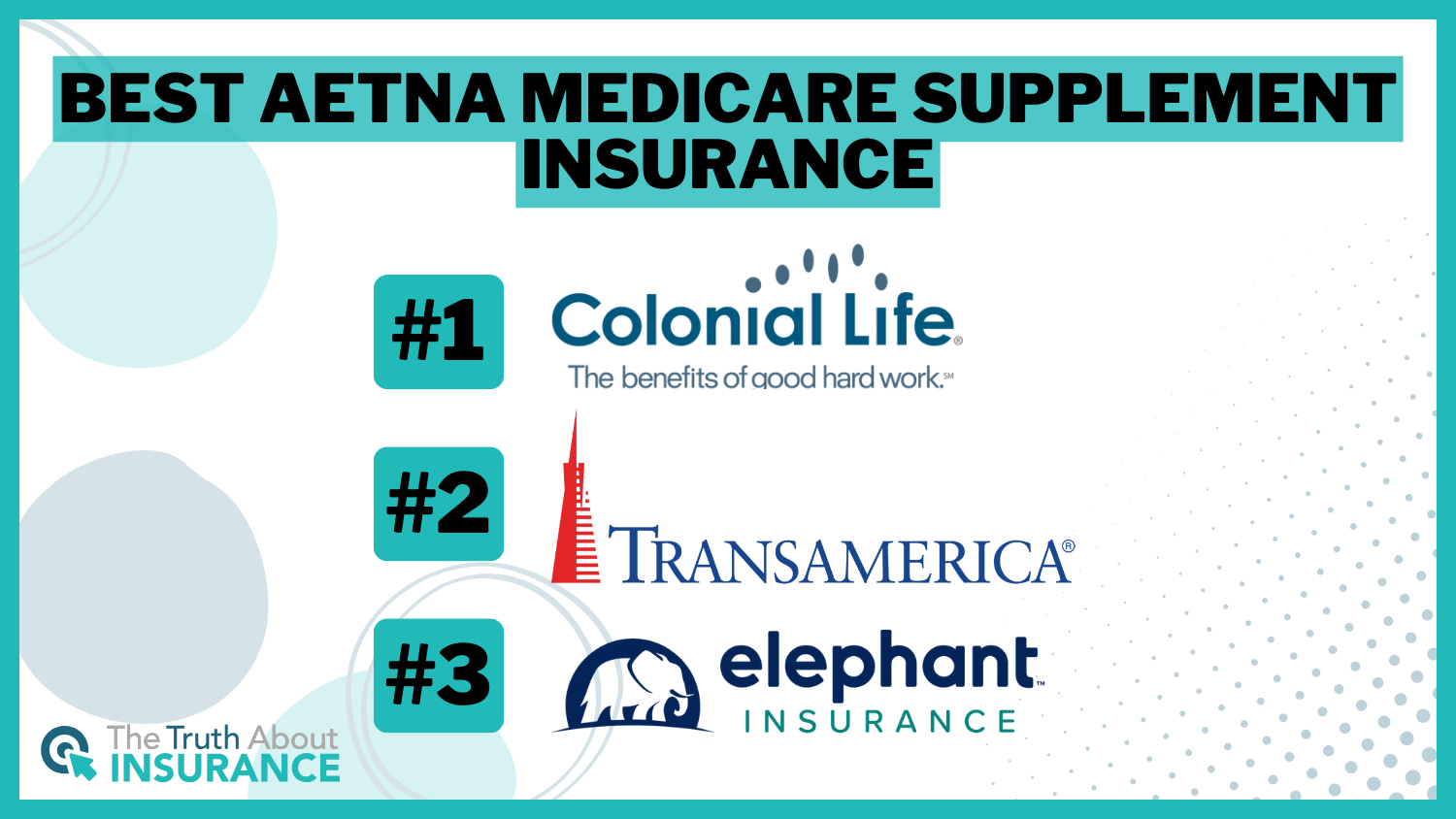

PostBest Aetna Medicare Supplement Insurance in 2024 (Top 8 Companies Ranked)

Colonial Life stands out as the premier option for the best Aetna Medicare supplement insurance, offering competitive rates starting at $82 monthly for thorough coverage. Teaming up with Transamerica and Elephant, they ensure affordability and top-notch protection designed to fulfill individuals’ supplement health insurance needs. Benefiting from strong financial backing and favorable feedback from customers,...

Colonial Life stands out as the premier option for the best ...