Prudential PruTerm WorkLife 65 Review (Coverage + Costs)

Prudential Life Insurance PruTerm was designed to provide people with life insurance coverage through their working years until retirement at age 65 when the policy would expire. PruTerm One offers short-term protection one year at a time. It’s a unique solution for those who have short-term loans or financial obligations that they want to protect against, but not the larger obligations that would necessitate a 10-, 20-, or 30-year plan.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Jan 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1848 |

| Current Executives | CEO – Charles F. Lowrey CFO – Ken Tanji |

| Number of Employees | 50,492 |

| Total Sales / Total Assets | $33,300,000,000 / $633,600,000,000 |

| HQ Address | 751 Broad Street Newark, NJ 07102 |

| Phone Number | 1-800-778-4357 |

| Company Website | www.prudential.com |

| Premiums Written – Group Life / Individual Life | $3,364,765,000 / $5,806,118,000 |

| Financial Standing | +5% From the Previous Year |

| Best For | Strong Financial Ratings, Best High-Risk Carrier, Universal Life Policies |

In 2011, Prudential Financial launched a new term life policy: PruTerm WorkLife 65®. The policy was designed to provide people with life insurance coverage through their working years until retirement at age 65 when the policy would expire.

It also included built-in employee protections. In the event of a disability during the term, the premiums were waived until the insured either recovered or turned 65. In the event of unexpected unemployment, the premiums could be waived for an entire year.

The policy was popular while it lasted, but has recently been discontinued.

Fortunately, Prudential has replaced it with new, quality term policies in addition to their traditional offerings. If you’d heard about PruTerm WorkLife 65® and were interested in it, you still have plenty of options at Prudential.

This review is designed to give you a complete overview of the company and guide you through all of their current policies to help you find the best life insurance coverage for your family.

You can also start comparing life insurance rates right now by using our FREE tool above.

How do you shop for life insurance quotes?

Purchasing a life insurance policy is one of the most important decisions you can make for your family. Life insurance coverage is the easiest way to ensure their financial security should you pass unexpectedly.

If you’re not sure whether you need life insurance, take a look at these findings from the 2018 Insurance Barometer Study from Life Happens and LIMRA:

- 35 percent of households would be financially impacted within one month of the primary wage earner’s death.

- 90 percent agree that the primary wage earner should carry insurance.

- 60 percent of all people living in the United States have life insurance.

- 20 percent of those with a policy feel their coverage is insufficient.

Prudential discusses the importance of buying a life insurance policy in the following video:

If you’ve decided to buy life insurance, here are some things to consider while you shop for a policy.

In general, life insurance should cover two types of obligations: immediate and future.

Immediate obligations are the things that need to be paid soon after your death. These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all of the expenses that you want to pay for after your death, those you expect and those you might not. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

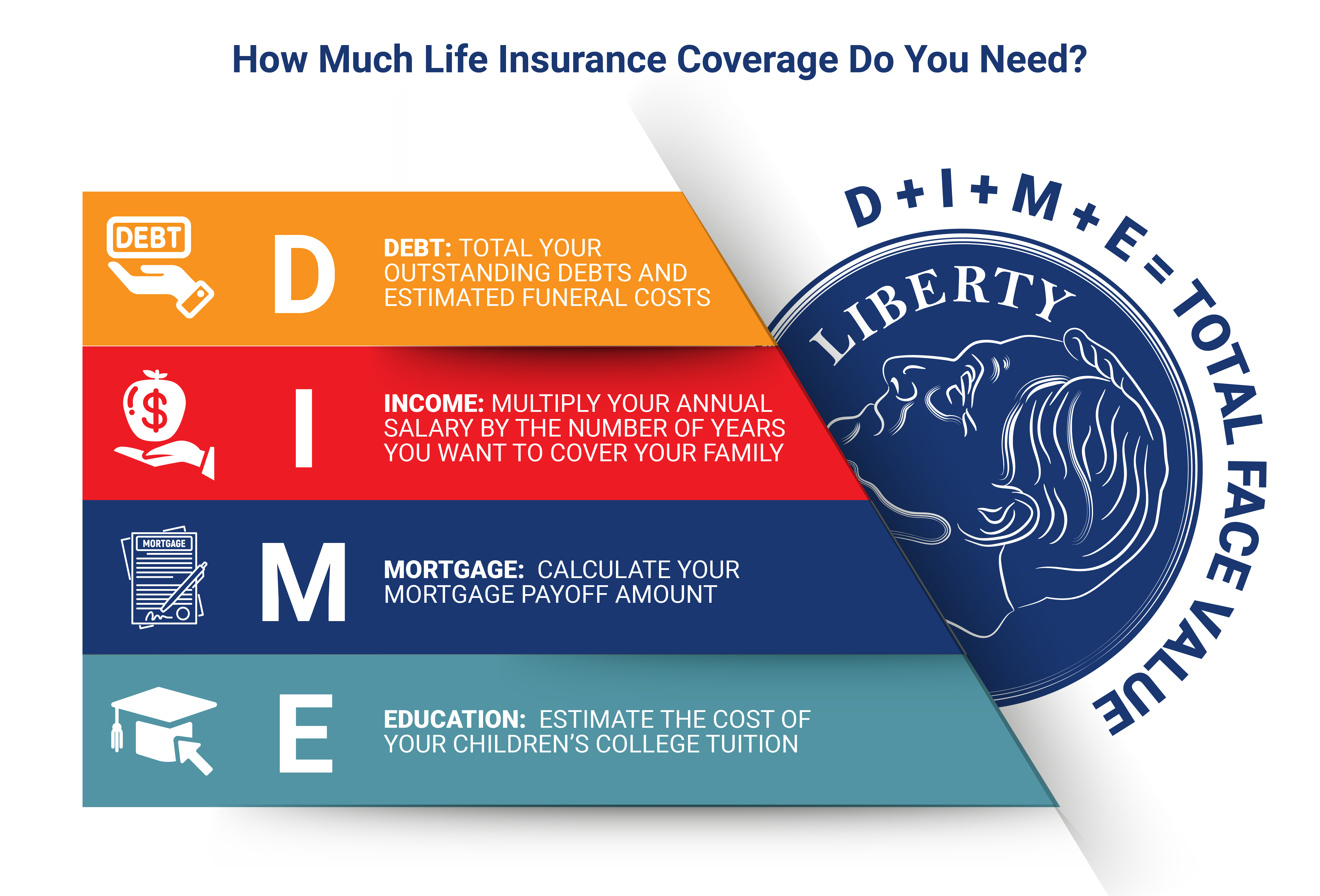

One popular method used by many online insurance calculators is the DIME method. DIME is an acronym which stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you the minimum face value you need.

Here is an example using the method.

A husband and father of two is shopping for life insurance. Both he and his wife work full time. He makes $75,000 per year.

The family has a remaining mortgage balance of $100,000, a $10,000 auto loan, and $5,000 in credit card debt.

The mortgage is the largest annual expense. With it paid, his wife will have less need for his income and can survive on her own. Still, he plans to leave her five years’ worth of his salary as an emergency savings fund in case unexpected bills arrive in the future.

The couple also plans on saving $30,000 to cover the average cost of four years of in-state tuition at a public university for each child.

After factoring in an average funeral cost of around $7,500, the man’s insurance needs are as follows:

- Debt – $10,000 auto loan + $5,000 credit card + $7,500 funeral costs = $22,500

- Income – $375,000

- Mortgage – $100,000

- Education – $60,000

- Total need – $557,000

That total means he should purchase a life insurance policy with a face value of around $600,000.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much are Prudential’s life insurance rates?

The following table illustrates how Prudential’s average annual rates on a 20-year, $100,000 policy at key ages compare to the average of the top 10 insurers by market share.

| Demographics | Annual Rates – Male | Versus Average Top 10 Insurers | Annual Rates – Female | Versus Average Top 10 Insurers |

|---|---|---|---|---|

| 25-Year-Old Non-Smoker | $176.40 | -$2.14 | $154.44 | -$6.13 |

| 25-Year-Old Smoker | $339.24 | +$17.48 | $265.68 | +$16.93 |

| 35-Year-Old Non-Smoker | $183.84 | -$1.20 | $157.56 | -$8.35 |

| 35-Year-Old Smoker | $398.04 | +$37.81 | $307.68 | +$21.50 |

| 45-Year-Old Non-Smoker | $244.68 | -$23.21 | $230.04 | -$10.21 |

| 45-Year-Old Smoker | $738.24 | +$100.73 | $584.88 | +$91.68 |

| 55-Year-Old Non-Smoker | $447.36 | -$77.59 | $346.56 | -$60.38 |

| 55-Year-Old Smoker | $1,714.68 | +$350.59 | $1,129.80 | +$138.17 |

| 65-Year-Old Non-Smoker | $1,339.89 | +$66.77 | $895.68 | +$15.02 |

| 65-Year-Old Smoker | $3,372.36 | +$127.31 | $3,052.80 | +$817.49 |

| Average Non-Smoker | $478.84 | -$7.07 | $356.86 | -$14.01 |

| Average Smoker | $1,312.51 | $126.78 | $1,068.17 | +$217.16 |

Prudential has premiums that are well below the average for non-smokers, but their policies are significantly higher for tobacco users.

What do you need to know about Prudential life insurance?

Having been in business for over 140 years, Prudential has a long and storied history. The company was originally founded in Newark, New Jersey, in 1875 as the Widows and Orphans Friendly Society, which was later renamed the Prudential Friendly Society.

In the beginning, Prudential was a mutual company that exclusively sold burial insurance at a premium of 3 cents per week. At the turn of the century, the company started to sell specialized life insurance to industrial workers, and then traditional life insurance to all customers.

Over the following 100 years, Prudential grew to become one of the largest financial service firms in the world, selling life insurance, health insurance, and a full slate of investment and retirement solutions.

Today, Prudential has over $1.5 trillion in assets under management in the United States and 40 countries throughout the world. Despite that international growth, Prudential’s headquarters are still located right where the company was founded in Newark, New Jersey.

Prudential is licensed to sell individual life insurance policies in all 50 states through one of their four subsidiaries:

- The Prudential Insurance Company of America

- Pruco Life Insurance Company

- Pruco Life Insurance Company of New Jersey

- Prudential Annuities Life Assurance Corporation

The company also sells employer-sponsored group insurance.

What are Prudential’s industry ratings?

Prudential’s life insurance ratings for 2019 give insight into the company’s financial strength, business practices, and quality of customer service.

The following table shows the current ratings:

| Ratings Agency | Prudential's Rating |

|---|---|

| A.M. Best | A+ |

| Better Business Bureau (BBB) | A+ |

| Moody’s | A1 |

| Standard & Poor (S&P) | A+ |

| Fitch Ratings | AA- |

The insurance company ratings from A.M. Best ratings, Moody’s financial ratings, Standard & Poor’s ratings, and Fitch financial ratings all measure an insurer’s credit risk, meaning their financial strength as it relates to their ability to pay all their policy obligations.

Prudential’s financial strength ratings reflect a strong company with low credit risk. Their rating with the Better Business Bureau reflects the same.

The Better Business Bureau assigns one of 13 letter grades based on factors such as time in business, open complaints, resolved complaints, and federal action against a company. Prudential has the highest rating.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is Prudential’s market share?

Prudential is a perennial top 10 provider of life insurance. They are currently the fifth-largest writer of individual life insurance with a 4.5 percent market share, representing $5.8 billion in direct written premiums.

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual Life Insurance Company | $10,547,469,000 | 8.2% |

| 2 | Lincoln National Corporation | $7,467,869,000 | 5.8% |

| 3 | New York Life Insurance Group | $7,331,015,000 | 5.7% |

| 4 | Massachusetts Mutual Life Insurance Company | $6,171,213,000 | 4.8% |

| 5 | Prudential Financial | $5,806,118,000 | 4.5% |

| 6 | John Hancock Life Insurance Company | $4,651,894,000 | 3.6% |

| 7 | State Farm | $4,593,999,000 | 3.6% |

| 8 | Transamerica | $3,770,584,000 | 3.6% |

| 9 | Pacific Life | $3,770,584,000 | 2.9% |

| 10 | MetLife | $3,724,165,000 | 2.9% |

The following table compares Prudential’s current performance versus previous years.

| Year | Rank | Direct Premiums Written | Market Share |

|---|---|---|---|

| 2015 | 5 | $5,081,952,000 | 4.2% |

| 2016 | 5 | $5,632,282,000 | 4.3% |

| 2017 | 4 | $5,754,809,000 | 4.5% |

| 2018 | 5 | $5,806,118,000 | 4.5% |

The company saw a slight drop in rank from 2017 to 2018. However, their amount of direct written premiums actually increased by around $50 million. Their business increased, but not as much as the nearest competitor, Mass Mutual.

The margin between the two companies is only separated by a few million dollars. They are likely to keep trading the fourth and fifth spots back and forth for the next several years.

Prudential is also one of the largest writers of group life insurance. They are currently ranked second with a 9.9 percent market share, representing $3,364,765,000 in direct written premiums.

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | MetLife | $7,133,718,000 | 21.0% |

| 2 | Prudential Financial | $3,364,765,000 | 9.9% |

| 3 | Securian Financial Group | $2,510,157,000 | 7.4% |

| 4 | New York Life Insurance Group | $2,054,828,000 | 6.1% |

| 5 | Cigna Corporation | $1,703,227,000 | 5.0% |

| 6 | Unum Group | $1,617,900,000 | 4.8% |

| 7 | Lincoln National Corporation | $1,357,411,000 | 4.0% |

| 8 | Hartford Life & Accident Insurance Company | $1,334,463,000 | 3.9% |

| 9 | Nationwide Mutual Group | $1,315,267,000 | 3.9% |

| 10 | CVS Health Corporation | $946,226,000 | 2.8% |

The following table shows how Prudential’s group business has performed over the past few years.

| Year | Rank | Direct Premiums Written | Market Share |

|---|---|---|---|

| 2015 | 2 | $3,544,761,000 | 10.6% |

| 2016 | 2 | $3,202,585,000 | 10.0% |

| 2017 | 2 | $3,260,346,000 | 9.2% |

| 2018 | 2 | $3,364,765,000 | 9.9% |

Prudential did slowly lose some of its market share from 2015–2017, but they regained a lot of that ground in 2018. It’s also worth noting that, despite the slight decrease, Prudential never lost its second-place rank in the industry.

Prudential currently ranks number 50 on the Fortune 500 list. They have consistently placed on the list for the past 25 years, a trend that will likely continue far into the future.

There’s no reason to think that Prudential won’t continue to be a top insurer for years to come.

Does Prudential have a website or app?

Prudential offers the ability to get a quote, purchase a term policy, pay your premiums, and file a life insurance claim on its website.

Prudential is also one of the many insurance companies using social media. They have an active presence on all major platforms.

Both their Facebook and Twitter pages are actively updated with information on the company and its offerings.

You can chat directly with a representative on their Facebook page who can answer any questions you have.

Prudential’s social media campaigns focus primarily on their retirement and investment services, but there is still a significant amount of information on their life insurance policies as well.

Does Prudential have commercials?

Prudential’s current ad campaign “State of US” features stories from real customers in different cities across the United States who illustrate the importance of financial planning for a variety of situations.

Much like their social media campaign, their ad campaign focuses mainly on the company’s retirement and investment services.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is Prudential active in the community?

Prudential is committed to giving back to the communities in which it operates. It does so through investments, grants, and contributions to various businesses and non-profit organizations that make a positive impact nationwide.

The following video shows how the company’s impact investments work:

Last year, the company gave:

- $273 million in impact investments

- $52.5 million in grants

- $24.4 million in donations

In addition to their monetary contributions, Prudential also encourages their employees to volunteer with causes important to them and provides them with the paid time to do so. Last year employees volunteered more than 92,000 hours in their local communities.

What do Prudential’s employees have to say?

Prudential employs about 50,000 people.

Glassdoor employee reviews for Prudential averaged 3.6 out of 5 stars based on nearly 3,000 reviews. A majority, 64 percent of current employees, say they would recommend the job to a friend.

In the following video, real employees discuss their experiences working for Prudential:

Prudential is currently ranked on the following notable lists:

- No. 273, Forbes America’s Best Employers

- No. 338, Forbes World’s Best Employers

- No. 96, Forbes Best Employers for Women

- No. 48, Forbes Best Employers for New Grads

- No. 374, Forbes Best Employers for Diversity

- No. 44, Fortune’s list of 100 Best Companies to Work For

Prudential has consistently proven itself to be a quality employer. When employees are happy, customers tend to be happier as well.

What kinds of life insurance policies does Prudential offer?

Prudential offers term, whole, and universal life options to meet a variety of financial needs. You can also choose from multiple riders to further tailor your policy.

Life insurance policies fall into one of two general categories, term or whole. Term policies only pay if the death occurs within a set time frame, usually between 10 and 30 years.

Whole policies have no term and pay whenever a death occurs, regardless of age. Some also build cash value by allocating a portion of your premiums into an interest-bearing account.

Whole policies have multiple variations: traditional whole life, universal life, guaranteed universal life, indexed universal life, and variable life.

Prudential offers term, universal, indexed, and variable policies. Let’s take a look at these different types of life insurance.

Term Life Insurance

A term policy is payable only if the death of the insured occurs within a specified period of time, usually between 10 and 30 years.

Once the term has passed, the insurer cancels the coverage.

There are generally no refunds on the premiums paid. Many policies can also be converted to a whole policy before they expire.

Prudential offers the following term policies:

Term Essential®

Term Essential® is a standard term policy that offers guaranteed 10-, 15-, 20-, and 30-year level-premium periods.

Policies can be converted to any permanent policy, guaranteed with no new medical exam.

For those ages 59 and under, the policy can be converted at any time before the end of the term or before the first policy anniversary after the insured turns 65, whichever comes first.

Term Elite®

The Term Elite® policy is similar to the Term Essential policy, but with additional conversion benefits.

If you convert your term policy to a permanent policy within the first five years, you’ll receive a credit on your first-year premium.

PruTerm® One

PruTerm® One offers short-term protection one year at a time. It’s a unique solution for those who have short-term loans or financial obligations that they want to protect against, but not the larger obligations that would necessitate a 10-, 20-, or 30-year plan.

To give you an idea of how much a term life policy might cost, we’ve compiled a list of average monthly sample rates at Prudential for a 10-year term policy for non-smokers at key ages.

| Ages | $100,000: Male | $100,000: Female | $250,000: Male | $250,000: Female | $500,000: Male | $500,000: Female |

|---|---|---|---|---|---|---|

| 25 | $13.83 | $12.25 | $18.16 | $15.53 | $29.75 | $23.63 |

| 30 | $13.92 | $12.25 | $19.03 | $15.53 | $30.63 | $23.63 |

| 35 | $13.92 | $12.25 | $19.25 | $15.53 | $31.07 | $23.63 |

| 40 | $15.67 | $13.30 | $21.00 | $17.28 | $34.57 | $27.13 |

| 45 | $17.68 | $16.28 | $23.63 | $22.75 | $39.82 | $38.07 |

| 50 | $21.88 | $21.27 | $31.28 | $30.41 | $55.13 | $53.38 |

| 55 | $28.18 | $23.80 | $42.88 | $34.35 | $78.32 | $61.25 |

| 60 | $37.72 | $29.49 | $66.28 | $47.25 | $125.13 | $87.07 |

| 65 | $58.45 | $41.13 | $119.66 | $73.50 | $231.88 | $139.57 |

Smokers can expect to pay significantly higher rates.

Universal Life Insurance

Universal policies offer the permanent coverage and cash value growth of a traditional whole plan, while also giving you the flexibility to adjust your monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low over time.

Universal policies come with two benefit options: fixed or increasing.

With a fixed death benefit, the policy premiums decrease over time as the cash value increases so that the payout is always equal to the initial face value.

With an increasing death benefit, the premiums and face value remain the same over time. As the cash value increases, the overall death benefit increases.

Some universal policies also allow you to take out loans against your cash value. The loans must be paid back, with interest. If you die before you’ve paid the loan, the balance will be deducted from the death benefit.

Universal life insurance has different subcategories, each of which are distinguished by how they accumulate their cash value.

Universal Life

With a basic universal life policy, your cash value grows at a fixed rate set by the insurer, similar to a traditional whole policy.

Indexed Universal Life

Rather than growing at a fixed rate set by the insurer, indexed universal policies allow the owner to allocate the cash value amounts to an account that grows according to an equity index such as the S&P 500 or the Nasdaq 100.

Variable Universal Life

Variable policies allow you to invest your cash value in stocks, bonds, and money market mutual funds, similar to an IRA or 401(k).

These policies come with the greatest risk. Depending on how the stock market performs, you could lose a significant portion of your cash value and possibly even see your face value decrease.

As their name implies, variable universal policies combine the benefits of universal and variable coverage.

You get the investment options of a variable policy and the flexibility to adjust your premiums and face values like a universal policy.

Prudential offers the following universal policies:

PruLife Universal Protector®

PruLife Universal Protector® is a standard universal life policy. It offers guaranteed coverage for as long as you live with a cash value that grows at a fixed rate.

This policy also comes in a survivorship version that covers both you and your spouse simultaneously. It only pays out a death benefit after both of the insured have died.

PruLife Essential UL®

PruLife Essential UL® is different from the basic universal policy in that it allows you to access benefits during your lifetime. You can access money from your cash value account through withdrawals and policy loans.

You can use that money to supplement retirement income or pay bills. Keep in mind that withdrawals will decrease your cash value and could impact your overall death benefit.

PruLife Index Advantage UL®

As the name implies, PruLife Index Advantage UL® is an indexed universal policy. It has four different investment options for building your cash value.

The first is a fixed interest rate account. The other three accounts are based on the performance of the S&P 500® Index. Each has a different cap and a floor of 0 percent to help protect against losses.

The policy also comes with a 20-year guarantee against lapse. That means your coverage is guaranteed, regardless of market performance.

A loss of cash value won’t negatively affect your death benefit.

This policy also comes with a survivorship option.

VUL Protector®

VUL Protector® is a variable universal life policy that comes with over 50 different investment options. Options include:

- Asset allocation funds

- Domestic equity funds

- Fixed income funds

- Index funds

- International and global equity funds

- Fixed-rate option

You can transfer funds between investment options up to 12 times per year for free.

This policy also comes with a survivorship option.

PruLife Custom Premier II®

PruLife Custom Premier II® is a variable universal life policy that offers all of the investment options of the VUL Protector® with the additional benefit of two no-lapse guarantee periods.

During those periods, your coverage and death benefit are guaranteed, regardless of market performance or losses to your cash value.

If you’re not sure what type of life insurance would be best for you, talk to an insurance agent about your needs and your budget.

Riders

Life insurance policies can be customized with riders that add additional coverages and benefits. Prudential offers the following:

- Child protection – Provides life insurance coverage for all eligible children

- Disability waiver of premium – If you become disabled, your premiums will be waived for the duration of the disability

- Living needs benefit – Gives early access to a percentage of the death benefit if diagnosed by a physician as having 12 months or fewer to live

- Accidental death benefit – Pays a benefit in addition to the death benefit of the policy if the insured dies as a result of qualifying accidental injuries

Riders will increase the cost of any policy, so it’s important to make sure that the added benefit outweighs the additional price.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What factors affect your life insurance rate?

Anything that increases your risk of an early death increases the chances the insurer will have to pay out on your policy. That higher risk classification will result in a higher premium.

Below are some of the most common factors that affect your life insurance costs.

Demographics

Several demographics can have a big impact on your life insurance rates.

Age – Age is a key factor in determining insurability. Young people obviously have a longer life expectancy than older people. The higher your mortality risk, the higher your rates.

Your cost will increase every year you wait to buy a policy. Some insurers also limit coverage amounts for people over certain ages.

Gender – Gender also plays an important role. Statistically, women have longer life expectancies than men. Because of that, women in the same risk classification typically pay lower premiums than men.

Current Health & Family Medical History

A healthy person traditionally has a longer life expectancy than someone in poor health. Therefore, the healthier you are, the lower your risk classification. A lower risk classification means lower rates.

To determine your overall health, insurers will require you to fill out a health questionnaire and may request access to your medical records. Some may require a complete medical exam and bloodwork.

Some key health measures insurers look for are obesity, blood pressure, cholesterol, chronic diseases, and drug use.

Even if a policy does not require a medical exam, underwriters still have access to public prescription and Medical Information Bureau (MIB) records, so it’s important to be honest on your application. If your records contradict your application, the insurer could deny your coverage.

Most insurers will also examine the health history of your immediate family to identify any potential hereditary medical issues such as diabetes, heart disease, or cancer.

It is possible to get a life insurance policy without submitting to a medical exam. This type of policy is typically called a guaranteed issue life insurance policy, and offers permanent coverage but with a much lower death benefit than most other whole life insurance policies.

You may also be able to secure a burial or final expense policy without submitting to a medical exam. If you are seeking life insurance that doesn’t require a medical exam, look for these two options and ask the life insurers you’re considering if they offer coverage without an exam.

High-Risk Occupations

The Bureau of Labor Statistics’ Census of Fatal Occupational Injuries shows that police officers, firefighters, construction workers, and others have higher injury risk than many professions.

If you have a job with a greater chance of accidental death, the life insurer will assign you to a higher risk category.

High-Risk Habits

Likewise, high-risk habits outside of work can also result in higher life insurance rates.

The most common high-risk habit that insurers look for is tobacco use.

Smokers almost universally pay higher rates than their non-smoking counterparts in every demographic.

For example, the average 25-year-old male non-smoker pays around $165 per year for a 10-year, $100,000 policy with Prudential. A 25-year-old smoker pays $310 for the same policy, almost twice as much.

That works out to an extra $1,450 paid over the life of the plan.

In addition to smoking, insurers will also ask about any other high-risk hobbies, such as flying, skiing, scuba diving, or any other activity that has a high potential for injury or death.

A single instance won’t result in a higher rate, but a regular hobby might.

Veteran or Active Military Status

Military status falls under the category of high-risk occupations. Most insurers charge higher rates to active duty military service members, and some don’t sell them policies at all.

How can you get the best rate with Prudential?

Your risk classification determines whether an insurer will raise your price from their base premiums. Those base premiums are generally based on three factors: mortality, interest, and company expenses.

Insurers use statistical mortality tables to estimate how many people in every demographic are likely to die each year. If they insure people in demographics with a high likelihood of death, they’ll raise their rates on them to minimize losses.

Insurance rates are also influenced by current interest rates.

Insurers increase their profits by investing the premiums you pay in bonds, stocks, and mortgages. A low expected return on those investments could result in higher premiums.

They also factor in all of their operating expenses. The more a company spends maintaining their business, the more of that cost they pass onto their policyholders.

Rates can also vary from state to state, though the NAIC is currently encouraging states to adopt laws that would provide more uniformity nationwide.

With so many variables affecting the cost of life insurance, how do you get the lowest rates?

Certain factors such as gender and family medical history are beyond your control. Therefore, the best thing you can do is change the variables you can.

First, make healthy choices. Blood pressure, BMI, and cholesterol are key measures on a medical exam. Try to improve them through diet and exercise. If you don’t have a lot of time before you plan to apply for life insurance, even a short, quick effort could make a big difference on the medical exam.

You should also do some research on the medical exam process. If you know what they’re looking for, you’ll know what you need to fix.

If you do smoke, not only is it important to quit, you should do so as soon as you can. Most insurers require you to be tobacco-free for at least a year before you can claim a non-smoking rate.

The insurer will verify your abstinence with a blood or urine test.

Second, buy early. The longer you wait to buy a life insurance policy, the older you’ll be when you apply for coverage. As discussed, older people pay higher rates.

For example, the average 30-year, $500,000 policy for a 35-year-old male, non-smoker at Prudential is around $470 per year. That same policy for a 35-year-old costs $700. That five-year jump increases the price by nearly 50 percent.

Finally, pay your premiums on time. Late payments will result in penalties and could lead to the cancellation of your policy.

If you have a policy canceled for non-payment, you can expect additional fees to get it reinstated, or higher rates at the next insurer.

How to Get a Quote Online

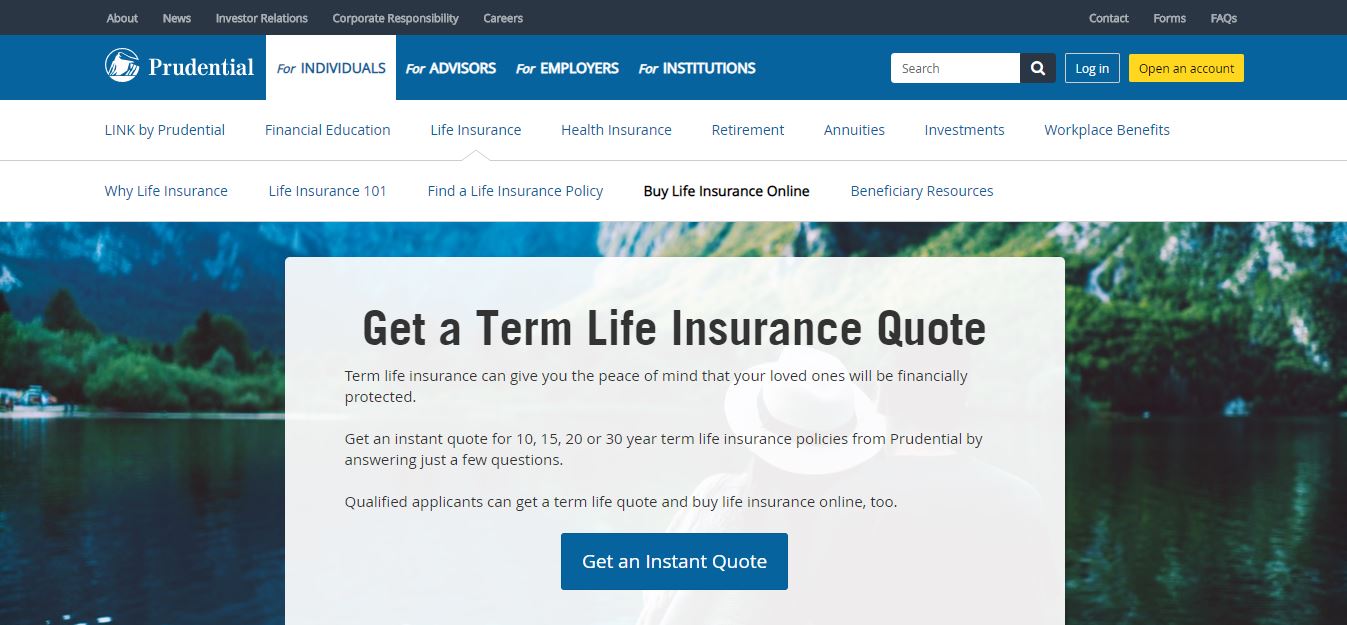

Getting an online quote from Prudential is simple. In just a few minutes, you can get a quote for a term policy.

Depending on your age, health, and coverage needs, you may also be able to apply and purchase the policy directly online.

How do you buy life insurance from Prudential online?

Next we will go over the simple process for applying for a life insurance policy from Prudential online.

#1 – Go to the Prudential Life Insurance Page

First, go to the Prudential website. Choose For Individuals > Life Insurance > Buy Life Insurance Online Products from the navigation menu.

The site will take you directly to the quote tool.

Click Get an Instant Quote to get started.

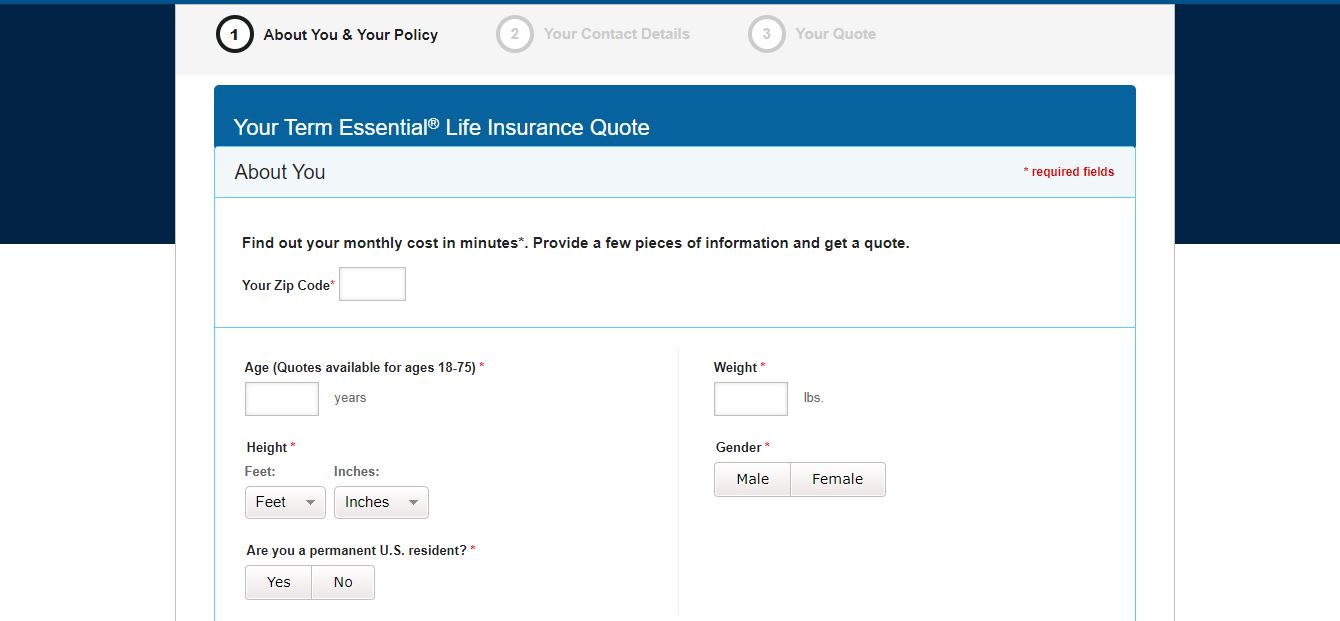

#2 – Enter Your Information

The quote tool will ask you to fill out your demographic information, coverage amounts, and medical history.

Enter your information and click Next.

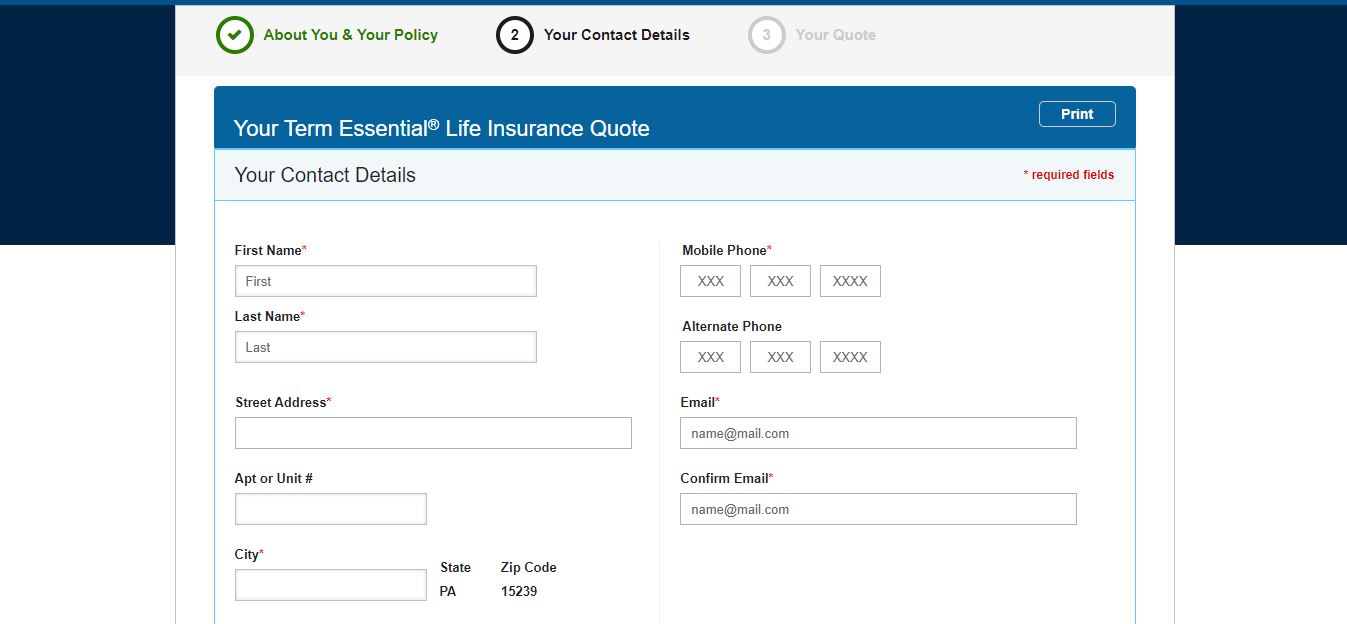

#3 – Enter Your Contact Information

Next, you’ll be asked to enter your contact information.

Your name, address, and phone number will help an insurance agent get in touch with you to discuss policy and purchase options.

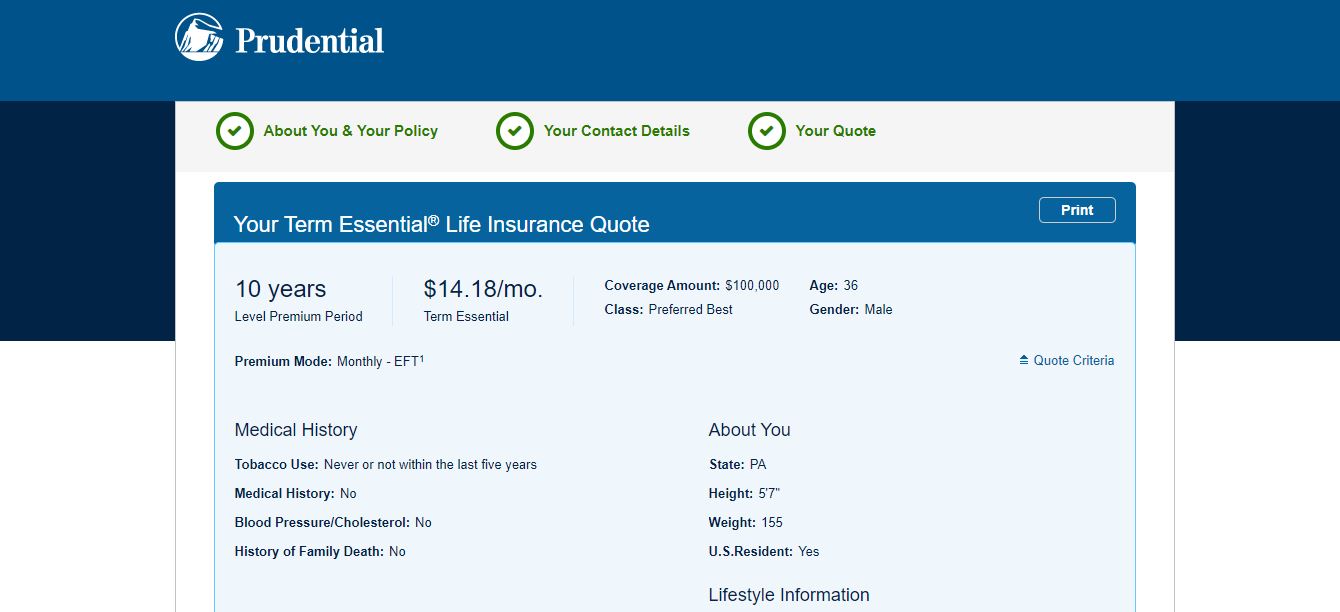

#4 – Get Your Quote

The tool will then return a monthly quote for a Term Essential® policy.

If you qualify based on your coverage amount, age, and medical history, the tool will then give you the option to apply for the policy directly online, without ever having to talk to an agent. If not, an agent will contact you within a few days.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do you cancel your Prudential life insurance policy?

If you need to cancel your policy completely, you can do so at any time.

There are generally no refunds on premiums when you cancel your life insurance unless you purchase a special rider on some permanent policies.

For a term policy, you would only receive a refund on prepaid premiums for an upcoming period.

To cancel a Prudential life insurance policy, call customer service at 1-800-778-2255.

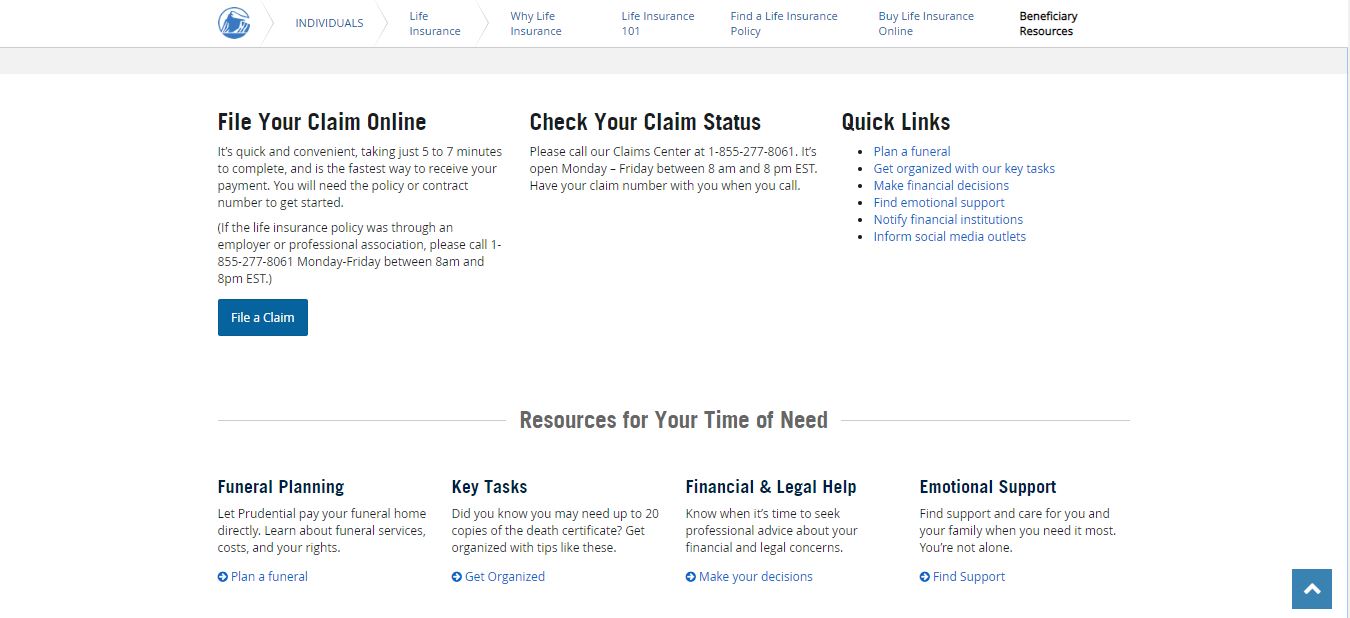

How do you file a claim with Prudential?

The overall process of filing a death benefit claim with Prudential follows general industry-standard steps:

- Initiate a claim

- Fill out company-specific paperwork

- Submit the paperwork along with a death certificate and any other requested documents

- Choose a disbursement method

- Receive the benefits

To initiate a claim with Prudential, you can either call customer service at 1-855-277-8061 or use their convenient online claim form.

When initiating a claim, you’ll need the following:

- Policy and Social Security numbers

- Name of insured

- Date of birth

- Date of death

- Funeral home name and phone number

Prudential will then send you a claims packet with all the forms you’ll need.

Does Prudential have good customer service?

Price is often the main deciding factor when choosing a life insurance company, but it’s also important to research the average customer experience.

A cheap life insurance policy isn’t a good deal if the company providing it is hard to contact, difficult to work with, and slow to pay benefits.

At the very least, you should do a quick internet search and read both the best customer experience reviews and the worst customer experience reviews. The truth probably lies somewhere between.

There are also some respected sources you can use to get an idea of how well an insurer interacts with their customers.

The National Association of Insurance Commissioners Complaint Index compares the number of complaints registered against an insurer each year with that of other companies. The NAIC sets the index at an average score of 1.00.

Prudential has a current score of 0.19, well below the industry standard.

Along those same lines, JD Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

The following table shows a breakdown of Prudential’s score:

| Factor | Score |

|---|---|

| Overall Satisfaction | 3/5 |

| Product Offerings | 3/5 |

| Price | 3/5 |

| Statements | 3/5 |

| Interaction | 3/5 |

| Communication | 3/5 |

| Application and Orientation | 3/5 |

As you can see, Prudential scored an above-average of three out of five in every category.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What kinds of programs does Prudential offer?

Prudential’s website includes a blog with articles on several life insurance topics. The section is small but informative.

The site also includes resources designed especially for beneficiaries.

In addition to the usual information on claim filing, there is also a funeral planning guide, a list of key tasks to get organized after the death of a loved one, and financial and legal advice, as well as links for finding emotional support.

Is Prudential’s website easy to use?

The Prudential website is well designed but can be a little difficult to navigate. Because the company offers so many different products and services, you’ll have to filter through a lot of menu options to find the life insurance information you need.

The life insurance product pages are also light on specific details.

The site is designed to give a brief overview of the policies, then guide you to an agent who can give you more detailed information.

Prudential does have a mobile app, but it’s designed exclusively for their banking, investment, and auto insurance products. You can’t use it to manage your life insurance policy. That said, their website is designed for mobile viewing.

Everything on the desktop site is accessible on the mobile site.

What are the pros and cons of Prudential life insurance?

As with any company, there are pros and cons to shopping with Prudential. Here are some of the biggest.

Pros

- Wide range of policy options

- Online quotes

- Online direct term policies

- Below-average rates for non-smokers

Cons

- Above-average rates for smokers

- Limited information online

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the bottom line?

PruTerm WorkLife 65® was an employee-centered policy that harkened back to Prudential’s earliest days of selling industrial life insurance. Though it has since been discontinued, that cancellation doesn’t leave a void in their product offerings.

Prudential is one of the oldest, largest, and most successful life insurance companies in the world and they have a wide selection of life insurance policies to match all of those distinctions.

Prudential’s rates are also significantly below the industry average. There’s a good chance they’ll have the policy to match your coverage needs with a price to match your budget.

This review was designed to give you a comprehensive overview of Prudential and their policy offerings now that PruTerm WorkLife 65® has been discontinued.

We hope that, after reading it, you have all the information you need to decide if Prudential is the right life insurer for you and your family. Did we leave any of your questions unanswered? If so, make sure to read the following frequently asked questions where you may find the answers you need.

Afterward, you can use the quote tool at the bottom of this page to compare quotes instantly from multiple insurers.

Frequently Asked Questions

Does Prudential offer a no-exam life insurance policy?

Prudential doesn’t offer a policy specifically advertised as no-exam. However, depending on your age, medical history, and the coverage amount, you could be approved for a Term Essential® policy without taking a medical exam.

Does Prudential offer any supplemental coverage?

No. Prudential does not offer supplemental disability or long-term care insurance for individuals, though some employer-sponsored group plans do have those options.

Can I change my Prudential Life Insurance PruTerm face value?

Yes, Prudential allows you to adjust your face value during specified periods.

Can I change my Prudential Life Insurance PruTerm term length?

No. Prudential doesn’t allow you to change your term lengths once coverage starts. However, you can convert a term policy to a permanent policy. If you’re unsure about the length you need, PruTerm® One allows you to buy coverage one year at a time.

Does Prudential offer group life insurance?

Yes. Prudential is one of the largest providers of group life insurance in the country.

How do I make a payment on my Prudential Life Insurance PruTerm premiums?

You can have your payments automatically debited from your checking account every month by filling out an authorization form or making electronic payments from a savings or checking account online.

Can I make withdrawals on my Prudential insurance policy?

Prudential’s universal policies allow you to take out loans against your cash value. Loans must be paid back with interest, or you risk decreasing or forfeiting your death benefit.

How long does it take for Prudential to pay death benefits on a life insurance policy?

Death benefits are typically paid within 30 days of processing the completed claim packet.

How easy is it to change my beneficiary?

You’ll need to fill out a beneficiary change form, which can be filled and submitted directly online or by mail. You can also request a beneficiary change through your sales agent.

Are the life insurance benefits taxable?

Life insurance benefits are non-taxable when they are paid directly to a beneficiary, such as a spouse or a child. However, if you name your estate as the beneficiary, the benefits are subject to estate taxes.

Are all Prudential insurance policies available in all states?

Yes. Prudential is licensed to sell all of its policies in every state through one of its two subsidiaries.

Where can I see my policy status and information?

If you need to review your policy details or check your policy’s status, you can log into your Prudential Online Account and check it there, or you can call your agent or the Prudential customer service phone number at (800) PRU-HELP (778-4357).

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.