Car Insurance Is More Expensive for Electric Cars

Car insurance for electric cars actually tends to be more expensive according to a recent study conducted by NerdWallet. The reason electric vehicles cost more to insure is because they’re generally more expensive than their gas-powered cousins. Also keep in mind that these electric vehicles have complicated components like high-priced batteries, and a special technician may be required to fix the thing.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Certified Financial Planner

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

So you’ve got your eyes on that new Tesla, do you? You know, the one that is autopilot equipped and able to go for some 270 miles before its next charge?

While that’s certainly cool, and a great way to save at the pump (because you don’t have to go to the pump), the car insurance coverage might not as cheap as you had hoped.

In fact, you may have been expecting a discount on your insurance costs for having an electric car as opposed to a gas-guzzler. After all, there are specific discounts for things like hybrid vehicles or cars that use alternative fuel. Why wouldn’t that also apply to your electric car as well?

If your car runs on electricity as opposed to gas, some sort of hybrid, or a different alternative fuel such as ethanol or compressed natural gas, your auto insurer may give you a 5-10% discount.

But here’s the problem: many if not all electric vehicles cost more than their counterparts, thereby making them more expensive to insure, even if you get a discount for driving one.

Remember, as we’ve noted in the past, it doesn’t matter how many discounts you receive. Only the final price matters. Why do you think all those high-priced stores constantly throw 20% off coupons your way?

They know their prices are already way too high and basically price in that discount via a markup, so if you don’t use the coupon, you’re getting truly ripped off. Though even if you do use the coupon, you still might not be getting the lowest price on the market.

How much more does it cost to insure an electric vehicle?

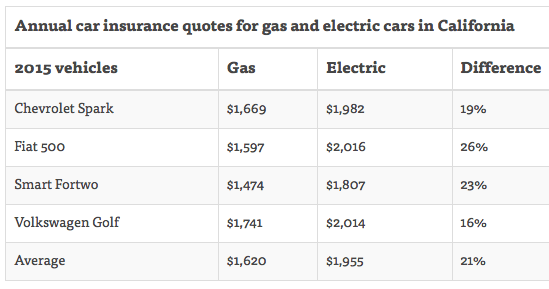

Regarding how much it costs to insure an electric vehicle, a recent study conducted by NerdWallet found that electric cars cost on average roughly 21% more to insure than gas powered vehicles.

The numbers are based on annual car insurance quotes for California drivers with the following coverage options:

– Liability limits of $100k/$300k/$50k per accident,

– $50,000 in property damage

– Collision and comprehensive coverage

– $500 deductible

– Medical payments protection

– Uninsured motorist coverage

That’s a pretty standard auto insurance policy there, which on average set a driver back $1,620 for a gas vehicle and $1,955 for the electric version of said vehicle.

As you can see, they compared four models that have both a gas version and a corresponding electric version.

In every instance the gas version was significantly cheaper, in one case as much as 26% cheaper. That meant the gas driver would save more than $400 annually on car insurance.

Read more: Average Cost of Car Insurance

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why do electric cars cost more to insure?

It’s pretty simple really. The reason electric vehicles cost more to insure is that they’re generally more expensive than their gas-powered cousins.

If a car is more expensive, it will cost more to insure because the insurance company will have to pay more for repairs, or to replace it if it’s stolen. The insurance industry, even though they exist to protect drivers, is also out to turn a profit. They won’t be able to do that if your expensive car is insured at a lower rate than what it costs to replace in the event of an accident.

Also keep in mind that these electric vehicles have complicated components like high-priced batteries, and a special technician may be required to fix such a problem. This means the car can’t just be taken to the insurer’s preferred body shop if it’s outside their scope of knowledge. Plus, with a specialized skill set comes a higher price tag. Paying someone who is certified in a specific field is going to be a lot more expensive.

Assuming you still want to purchase an electric car, expect rates to be pretty constant from insurer to insurer regardless of how it’s powered. There’s going to be extra cost associated with the vehicle types that are more expensive to repair or replace.

For example, the study found that Mercury Insurance was the most affordable car insurance for all the electric cars in the study. Mercury also tends to be the cheapest for conventional vehicles too.

Read More: Most Expensive Cars to Insure

How can you save money on your electric vehicle’s auto policy?

First of all, look into any local or federal tax credits you might be entitled to for driving an electric vehicle. The federal government offers a tax credit of up to $7,500.

Then, the best way to lower your insurance premiums is to ask your provider about insurance discounts. Common car insurance discounts offered by most major insurers include:

- Good student discount

- Multi-vehicle discount

- Safe driver discount

- Defensive driving/driver education course discount

- Multi-policy discount

- Vehicle safety features discount

- Automatic payments discount

If you don’t specifically ask, you might not be getting the discounts you’re entitled to. Your provider isn’t going to be aware of what’s happening in your life, so if you get married or move, you’ll have to let them know so they can adjust your rates. Also, keep in mind that people with clean driving records generally pay the lowest auto insurance rates, so it pays to drive safely. Having a clean driving record will open up further benefits with your provider. Keeping your credit score in good condition will help as well. Not that your credit rating should stop you from getting insurance; there are many companies out there who work with people no matter their credit score.

Read more: Why Did My Car Insurance Rate Go Up? No Accident or Ticket

What’s the bottom line?

The average cost of a new electric car is $40,000. That’s more than twice the price of an equivalent gasoline-powered vehicle and you’ll pay about three times as much to insure your electric vehicle. The reason: It costs more to repair or replace these vehicles.

As noted, while some auto insurance companies may offer a discount for an electric or hybrid vehicle, the cheapest insurance will probably still come from the company that insured your gas-powered vehicle.

But be sure to shop around to see if there are any specials for electric vehicles that push the price down any lower, and don’t hesitate to ask about any applicable discounts.

Read more: How are car insurance rates determined?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel...

Certified Financial Planner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.